Some might have taken the acknowledgement of war by François Holland after the attacks on Paris last November as a coup of drama by an unpopular President. Unfortunately, such is not the case, and it is not just France that is at war, the whole European Union is. Destroying the Union is effectively one of Daesh's goals, the motive behind its multiple attacks last Tuesday in Brussels. It is therefore capital to understand the rise of the Front National in France, the UKIP in Britain, the Alternatif fur Deutschland in Germany or the Golden Dawn in Greece as fulfilments of this goal. As Catholics mourn and celebrate the death and resurrection of Jesus Christ, it is perhaps time to remember the philosophical foundations laid 2 000 years ago that still support much of the European identity today. Bending to hate and fear is simply loosing this war.

Some might have taken the acknowledgement of war by François Holland after the attacks on Paris last November as a coup of drama by an unpopular President. Unfortunately, such is not the case, and it is not just France that is at war, the whole European Union is. Destroying the Union is effectively one of Daesh's goals, the motive behind its multiple attacks last Tuesday in Brussels. It is therefore capital to understand the rise of the Front National in France, the UKIP in Britain, the Alternatif fur Deutschland in Germany or the Golden Dawn in Greece as fulfilments of this goal. As Catholics mourn and celebrate the death and resurrection of Jesus Christ, it is perhaps time to remember the philosophical foundations laid 2 000 years ago that still support much of the European identity today. Bending to hate and fear is simply loosing this war.

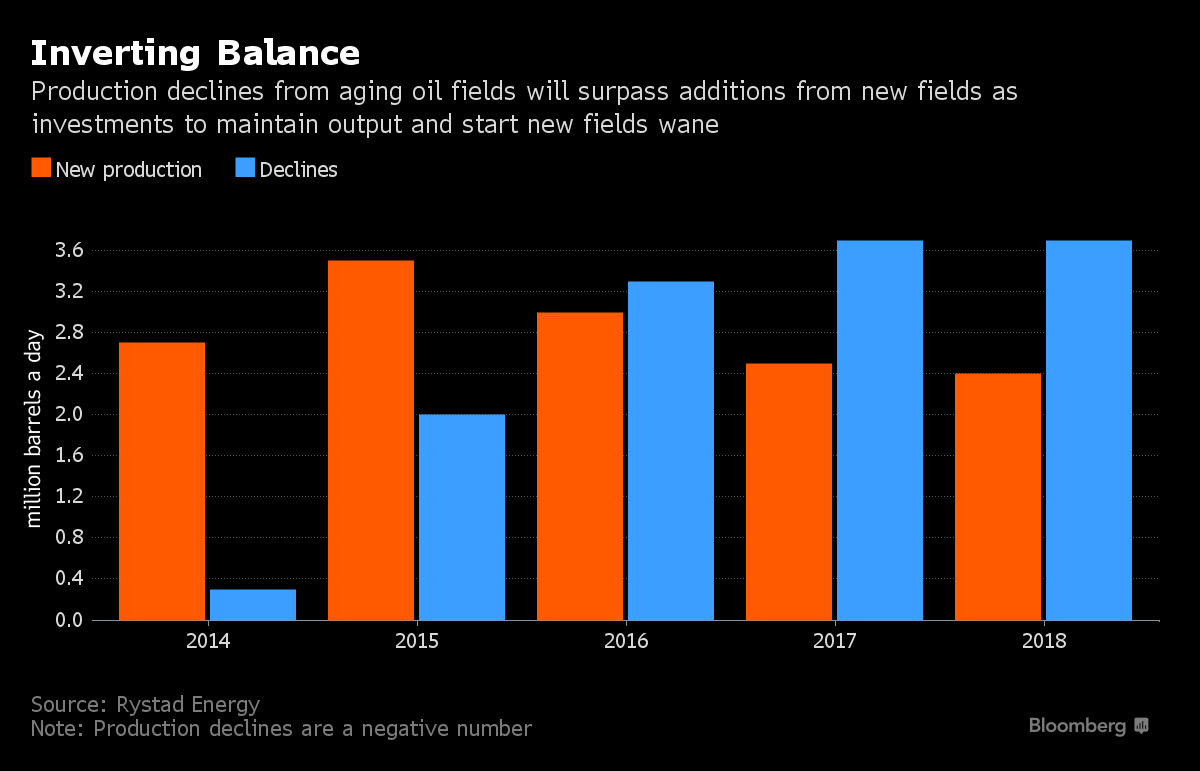

"Oil peaked in 2015" is becoming a recurrent claim. This time however, it was not issued by Ron Patterson or Euan Mearns, it is claimed by a major mainstream media outlet. Making reference to a report issued by Rystad Energy, Bloomberg lays down a clear picture: world petroleum extraction is to diminish slightly this year, decline over 1 Mb/d in 2017 and 2018 and this trend should accelerate afterwards. They just do not dare to say it, but it is all out there in the open for every one to see.

Is this it? I usually prefer a word of caution, considering the geo-political hurdles hanging on major petroleum exporting regions such as Lybia, Iraq and Iran. Peak Oil is a secular event, not exactly fitting the frenetic rhythm of the always on-line modern way of life. But after more than a decade studying this subject, this is indeed the first time I feel this civilisation changing moment could actually be behind us.

BloombergAs a matter of fact, world petroleum extraction seems to have declined more in the first two months of 2016 that what Rystad is projecting for the entire year. The sort of economic and political issues affecting the countries referred is most likely to expand to other petroleum exporting economies.

Drillers Can't Replace Lost Output as $100 Oil Inheritance Spent

Rakteem Katakey, 22-03-2016

For oil companies, the legacy of $100 crude is starting to run dry.

A wave of projects approved at the start of the decade, when oil traded near $100 a barrel, has bolstered output for many producers, keeping cash flowing even as prices plummeted. Now, that production boon is fading. In 2016, for the first time in years, drillers will add less oil from new fields than they lose to natural decline in old ones.

About 3 million barrels a day will come from new projects this year, compared with 3.3 million lost from established fields, according to Oslo-based Rystad Energy AS. By 2017, the decline will outstrip new output by 1.2 million barrels as investment cuts made during the oil rout start to take effect. That trend is expected to worsen.

“There will be some effect in 2018 and a very strong effect in 2020,” said Per Magnus Nysveen, Rystad’s head of analysis, adding that the market will re-balance this year. “Global demand and supply will balance very quickly because we’re seeing extended decline from producing fields.”

OilPrice.comIraq is falling into deep trouble with the decrease in petroleum revenues to sustain the war against Daesh. There are some shy signs of NATO committing to this war, but far from anything that could definitely change its course.

Supply Outages in OPEC Countries Push Up Oil Prices

Nick Cunningham, 19-03-2016

Much of the current oil price rally – up about 50 percent in less than two months – is due to the growing optimism in the markets. That is, the price surge is driven by speculative movements, bets that oil prices will rise.

However, the speculators are not entirely off base. While the underlying fundamentals still look pretty grim, there are some tangible impacts taking place in the world of oil supply and demand that are contributing to that bullish sentiment. First, probably the most closely watched stream of data comes from U.S. shale, which is posting steady declines each week.

But more recent data shows unexpected supply outages from several OPEC members, disruptions that have trimmed the group’s collective output by nearly 200,000 barrels per day.

International Business TimesAn alternative take on the motives behind the Suni-Shiite war. Independently of the veracity of the claims in this article, the information it carries on energy supply routes in the region is too valuable to miss.

US Marines Enter Battle In Iraq To Help Army And Peshmerga Defend Oil Fields From ISIS

Erin Banco, 23-03-2016

The Islamic State group is trying to retake control of the oil fields it lost two years ago in the semi-autonomous region of Iraqi Kurdistan by launching rockets at Kurdish and Iraqi soldiers. In an attempt to earn back the massive amount of cash it used to fund its international terrorism in 2014, the group has focused its resources on attacking Makhmur, a city just 75 miles miles from the oil-rich city of Kirkuk. So far, the group, also known as ISIS, has succeeded in outgunning the Iraqi forces in the city, but a new contingent of American Marines might change the outcome on the ground.

“Several weeks ago, thousands of Iraqi troops began occupying a tactical assembly area in Makhmur. This is part of the force generation associated with the liberation of Mosul,” Col. Steve Warren, spokesman for the fight against ISIS in Iraq and Syria, said in a press briefing this week. Mosul is the de facto ISIS headquarters in Iraq. “These Iraqi forces, along with their coalition advisers, require force protection,” Warren said. “So we constructed a small fire base to do just that.”

The U.S. Marines in Iraq are on the front line and have been tasked with protecting Iraqi units in Makhmur — a scenario President Barack Obama wanted to avoid as long as possible during his time in office.

OrientalReview.orgThe petroleum supply destruction cycle has a different dynamics in the OECD. Banks and investment funds are finally taking in the consequences of opening the financing floodgates to what is largely a money loosing industry. What goes around comes around.

Great Game & Partitioning Of Syria

Shelley Kasli, 19-03-2016

Russia’s decision to greatly reduce its military presence in Syria, coming as it did with little warning, has left the world struggling for explanations. Russia is to maintain a military presence at its naval base in Tartous and at the Khmeymim airbase. In fact Russia is “withdrawing without withdrawing”.

The partial withdrawal is seen by many as a message to the Assad government to not take Russia’s military aid for granted, and to be more flexible in the upcoming peace negotiations.

As Robert F. Kennedy Jr., attorney and nephew of US President John Fitzgerald Kennedy explains, the major reason for the west’s attempt to overthrow the Assad government was to build a natural gas pipeline from Qatar that traversed Syria, capturing its newly discovered offshore reserves, and continued on through Turkey to the EU, as a major competitor to Russia’s Gazprom.

By re-establishing the Assad government in Syria, and permanently placing its forces at Syrian bases, the Russian’s have placed an impenetrable obstacle to the development of the Qatar gas pipeline. Russia has also placed itself at the nexus point of other new offshore gas discoveries in the Eastern Mediterranean, including Israel, Cyprus, and Greece.

Financial TimesThese mainstream media articles on the "shale" débâcle usually claim the industry can easily hike up extraction if prices return to the levels of two years ago. However, the various data fragments publicly available seem to indicating that even at 100 $/b the so called "shale industry" was largely unprofitable. The article below is a good wrap up of the shale sub-prime story so far.

Oil and gas: Debt fears flare up

Ed Crooks, 21-03-2016

[...] In the US and Europe, banks have been quick to reassure shareholders that, while their losses are mounting, they are entirely manageable. French banks account for four of the 10 banks with the highest exposure. Crédit Agricole, whose $29.8bn credit exposure to energy is the second highest in Europe, has told investors that 84 per cent of the portfolio was investment grade. The disclosures were largely effective in soothing fears about energy debt.

However, the pace at which loan provisions is rising has been unsettling some. JPMorgan Chase told investors in mid-February that it would take another $500m charge to its reserves in the first quarter to cover likely losses on energy loans, a few weeks after it had said that it would take about $750m of charges for the full year.

Comerica, the Dallas-based lender, revealed in a regulatory filing last month that $75m-$125m of additional energy-related expenses would be recognised “primarily” in the first quarter — a departure from its previous guidance that the hit would be taken “particularly” in the first half of the year.

“It’s alarming that things are getting pulled forward so much,” says Julie Solar, an analyst at Fitch Ratings. “The pace of deterioration is coming quicker than what was previously disclosed.”

CredoBelow is an update on the strain water supply is casting on Coal extraction in China, an issue first highlighted in this space almost three years ago. Interesting to see that India is also facing similar problems.

Shale Euphoria: The Boom and Bust of Sub Prime Oil and Natural Gas

23-3-2016

The aim of this article is to show that the shale industry, whether extracting oil or gas, has never been financially sustainable. All around the world it has consistently disappointed profit expectations. Even though it has produced considerable quantities of oil and gas, and enough to influence oil and gas prices, the industry has mostly been unprofitable and has only been able to continue by running up more and more debt. How could this be? It seems paradoxical and defies ordinary economic logic. The answer is to be found in the way that the shale gas sector has been funded. It is part of a bubble economy inflated by monetary policy that has kept down interest rates. This has made investors “hunt for yield”. These investors believed that they had found a paying investment in shale companies – but they were really proving that they were susceptible to wishful thinking, vulnerable to hype and highly unethical practices that enabled Wall Street and other bankers to do very nicely. Those who invested in fracking are going to lose a lot of money.

QuartzThe President of Cyprus furnished an interview to the Oil magazine full of optimism regarding the Gas reserves found in his country's waters. Irrespectively of how many of these rosy prospects can effectively come to fruition, it is important to note how Greece is set to become one of the major Gas hubs of Europe. It now has prospects to host supply lines arriving from Russia, North Africa, the Near and the Middle East.

China’s and India’s coal expansion plans have a major flaw, Greenpeace says

Zheping Huang, 21-03-2016

Coal is thirsty at every stage of its life circle—from mining, cleaning, and burning to the treatment of coal ash. The world’s coal power plants consume enough freshwater to sustain 1 billion people, the latest Greenpeace report finds.

The report, published today (Mar. 22), is the first global plant-by-plant study of the water demand in the coal industry’s. Globally, the world’s 8,359 existing coal plants consume 19 billion cubic meters of water per year, enough to meet the most basic water needs of 1 billion people. And if all the 2,668 planned coal plants come online in the next decade, the industry’s water consumption will nearly double to 36 billion cubic meters per year, the report said.

Making matters worse, a quarter of existing or proposed coal plants are or will be located in regions where water is being used faster than it is being replenished naturally—what Greenpeace calls “red-list” areas. This means there is not enough water left for the area’s ecological needs, including sustaining ground vegetation and flushing out pollutants in rivers in those regions, the report said.

The water/coal conflict is worst in China. Nearly half of China’s existing and proposed coal plants are in red-list areas, the report found. “China is facing a resource dilemma—wherever it has coal, there is often limited water,” the report wrote. India ranks the second on both lists, with 24% of existing coal plants and 13% of proposed ones in “red-list” areas.

About OilIn spite of the big numbers on Petroleum opening this review, there is an unusual number of interesting stories on renewable energy this week. Starting with falling prices shapping energy policy. I never tire of pointing that if renewable energy is not expanding faster in Europe is because governments are not willing to.

Our strategy? To bring gas to Europe

Simona Manna, 25-03-2016

After coming out with flying colors from a tough economic crisis that broke out 3 years ago, Cyprus speeds on towards its goal: to play a leading role in the energy cooperation between the countries of the region, most notably between Israel, Egypt and Greece. But the island country’s ambition is also political and diplomatic, as President of the Republic of Cyprus Nicos Anastasiades explains in this exclusive interview with Oil.

Approximately 2 years ago, the production test began at the Aphrodite gas field in block 12. An event then defined by the Energy Minister, Giorgos Lakkotrypis, as “very symbolic.‘ Since then, what has been happening in the Levante Basin? Since the production test in the Aphrodite gas field, the exploration activity in Cyprus’ Exclusive Economic Zone (EEZ) continued in all 5 licensed Blocks. In June 2016, the B12 Contactor submitted a preliminary Field Development and Production Plan, an event of paramount importance towards the exploitation of the Aphrodite gas field. Moreover, Eni’s announcement last August of the world class “Zohr‘ gas discovery in offshore Egypt was also a very important milestone since it confirms the significant gas potential of the Eastern Mediterranean region. The aforementioned discovery, which is only 6 Km away from Cyprus’ EEZ, has proven that apart from the conventional reservoirs that originated mostly by the Nile Delta Basin and from which all previous gas discoveries were associated with, there is now a new carbonate reservoirs concept, which changes the exploration focus in the Eastern Mediterranean region and is fully associated with the Eratosthenes Continental Block within our EEZ. This development has attracted the interest of multiple oil majors, not only for exploration purposes but for investments as well. Consequently, the Council of Ministers of the Republic of Cyprus has decided to launch a third licensing round for oil and gas exploration in the Cyprus EEZ.

The Hans IndiaAnd then some megalomania. There is indeed a secular trend for wind turbines to get larger when deployed at sea - but this project is well beyond anything imagined before. As usual, the time-line for the realisation of such projects is put well into the future, meaning that the engineering is not exactly there yet. Instead of playing the sceptic type, I would rather wish good luck to this research team; may their work be useful, even if they miss the goals of the project.

Cheaper renewable energy outpaces nuclear power

20-03-2016

Renewable-energy generation in India was 61.8 billion units, versus 36.1 billion units of nuclear-power generation during the financial year (FY) 2014-15. Renewable energy accounted for 5.6 percent of electricity generated in India, against 3.2 percent for nuclear power.

Renewable energy has been growing at a faster pace than nuclear power over two years. During 2013-14 and 2014-15, renewable energy grew at 11.7 percent and 16.2 percent, respectively, while nuclear-power growth has been almost flat over the same period.

If the 2022 solar target is met, it will become India's second largest energy source. The bulk of India's renewable energy comes from wind, but solar energy is growing faster with installed capacity reaching 5,775 mega watts (MW) in February 2016.

FutureEnTechOther technologies do not seem so far fetched. Tidal power is one of the emerging technologies progressing the fastest at the moment. And for countries like Scotland, were the declining costs of PV can not have the same impact as in other latitudes, expanding the local and sustainable energy mix is capital.

Researchers are developing the World’s Biggest Wind Turbine with 656-foot long Blades which is 30 m taller than the Empire State Building

21-03-2016

[...] A Department of Energy-funded research group spanning several American universities is proposing a wind energy scheme involving almost unimaginable scales. The technology, which is still several years off from even being tested, would be capable of generating 25 times the power of a contemporary conventional wind turbine, but it would also come at a cost.

As Rob Nikolewski reports for the LA Times, the new turbine will reach 479 metres (1,574 feet) into the sky - a height that's 30 metres (100 feet) taller than the Empire State Building. To keep it stable, the structure would have a diameter of roughly 400 metres (1,312) feet.

Image credit: Sandia Labs.

QuartzThe mainstream media really works in a logic of their own, far from matching the public needs for independent information. Less than one year after the over-hype on the Powerwall battery, Tesla is already discontinuing one of these products. This time around hardly any media took notice. Tesla is now focusing on its 7 kW battery, but as I have shown, not even that is a viable product, no matter the amount of free publicity the press employs on it.

The latest innovation in renewable energy is an army of huge, sunken turbines in Scotland’s wild seas

Cassie Werber, 12-02-2016

Intuitively, humans look at the ocean and see an awesome energy: the inexorable suck and return of tides; the swell and crash of 60-foot waves. In the increasingly urgent pursuit of alternatives to fossil fuels, ocean energy is a clean-tech holy grail.

But harnessing that power has been an equally awesome challenge. The quest thus far has involved university professors with tanks full of prototypes, and hugely expensive undersea experiments. Now, with the estimated £1 billion ($1.5 billion) MeyGen turbine project under construction in Scotland’s Pentland Firth—and others like it on the way—the promise of tidal energy has never been closer.

MeyGen is still under construction, with undersea cables being laid and substations built. Once all 269 turbines are in place, MeyGen will generate 400 megawatts of power—enough for 175,000 homes, says Tim Cornelius, the CEO of Atlantis Resources, which is building the turbine array.

GreenTechMediaClosing some food for thought on the implications of the energy transition we are living to economic policy. With Central Banks driving interest rates below 0% it seems the limits to Monetarism have been reached. Naturally, the calls for a return to Keynesian policies grow louder. But is it a solution to our problems? A good theme for an essay when time allows.

Tesla Discontinues 10-Kilowatt-Hour Powerwall Home Battery

Julia Pyper, 18-03-2016

Tesla has quietly removed all references to its 10-kilowatt-hour residential battery from the Powerwall website, as well as the company’s press kit. The company's smaller battery designed for daily cycling is all that remains.

The change was initially made without explanation, which prompted industry insiders to speculate. Today, a Tesla representative confirmed the 10-kilowatt-hour option has been discontinued.

"We have seen enormous interest in the Daily Powerwall worldwide," according to an emailed statement to GTM. "The Daily Powerwall supports daily use applications like solar self-consumption plus backup power applications, and can offer backup simply by modifying the way it is installed in a home. Due to the interest, we have decided to focus entirely on building and deploying the 7-kilowatt-hour Daily Powerwall at this time."

BloombergA musical suggestion in these times of mourning, let it convey our sadness.

Ignored for Years, a Radical Economic Theory Is Gaining Converts

Michelle Jamrisko, 14-03-2016

In an American election season that’s turned into a bonfire of the orthodoxies, one taboo survives pretty much intact: Budget deficits are dangerous.

A school of dissident economists wants to toss that one onto the flames, too.

It’s a propitious time to make the case, and not just in the U.S. Whether it’s negative interest rates, or helicopter money that delivers freshly minted cash direct to consumers, central banks are peering into their toolboxes to see what’s left. Despite all their innovations, economic recovery remains below par across the industrial world.

Calls for governments to take over the relief effort are growing louder. Plenty of economists have joined in, and so have top money managers. Bridgewater’s Ray Dalio, head of the world’s biggest hedge fund, and Janus Capital’s Bill Gross say policy makers are cornered and will have to resort to bigger deficits.

Have a good Easter.

No comments:

Post a Comment