20 December 2014

Press review 20-12-2014 - Contraction

Russia popped in the news in the first days of the week with drastic measures to support the ruble. The parallels with previous historical petroleum price bottoms in 1998 and 1985 are obvious and do not spell anything good. And it is not only petroleum, Russia relies on exports of all sorts of raw materials whose prices have fell across the board during 2014, in face of an anaemic world economy. One thing is now certain: 2013 will go in history as the year petroleum extraction in Russia peaked. Henceforth it is mostly about the steepness of the decline.

13 December 2014

Press review 13-12-2014 - A bursting bubble

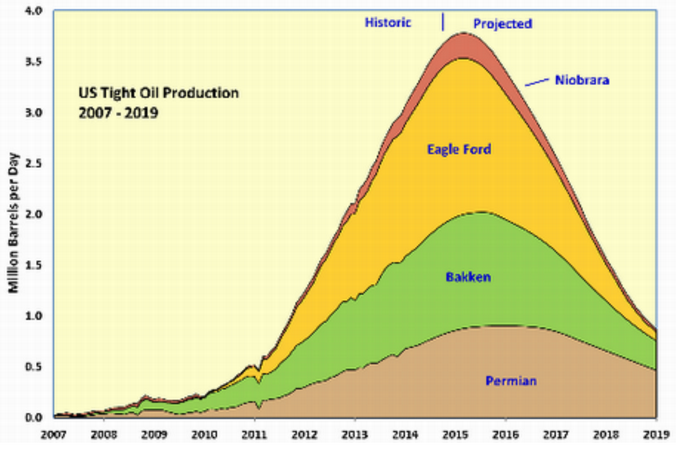

American energy writer Richard Heinberg entitled his book on petroleum extraction from source rocks "Snake Oil". This title was a sharp choice, possibly in more ways than Richard himself could have anticipated. For a few years the US investment community was completely intoxicated with stories of limitless supplies of fossil fuels and even energy independence. Every day more wells would be drilled, more infrastructure would be sourced, more news of a bright future would be written. And more debt would be issued to feed the beast.

American energy writer Richard Heinberg entitled his book on petroleum extraction from source rocks "Snake Oil". This title was a sharp choice, possibly in more ways than Richard himself could have anticipated. For a few years the US investment community was completely intoxicated with stories of limitless supplies of fossil fuels and even energy independence. Every day more wells would be drilled, more infrastructure would be sourced, more news of a bright future would be written. And more debt would be issued to feed the beast.

Until one day. It turns out source rocks were not so good after all, relying on wells with lifetimes counted in years, instead of decades. Thousands of millions of dollars were piled up on resources lying at the top end of the supply curve, thus vulnerable to the slightest shifts in the market equilibrium. Today that equilibrium renders source rocks money loosers and battered investors flee the market in hordes. Behind they leave a pile of debt on the verge of collapse, threatening the whole financial system; and not only in the US.

06 December 2014

Press review 06-12-2014 - Bitter Oranges

This week I attended the opening session of a photo-exhibition on the

life of illegal immigrants stranded in Italy. Either because they fail to obtain a working visa or because they are prosecuted in their country of origin, these immigrants are left to their luck, at best getting a place to sleep in a container or a tent.

This week I attended the opening session of a photo-exhibition on the

life of illegal immigrants stranded in Italy. Either because they fail to obtain a working visa or because they are prosecuted in their country of origin, these immigrants are left to their luck, at best getting a place to sleep in a container or a tent.

Three Luxembourgish researchers have been visiting regularly the camps where these immigrants live, documenting their stories and the ordeals they go through just to survive. They have to work to buy food and clothing; the orange harvest is the only possibility, where they can earn 0.5 € for each box of 22 kg. At the height of the harvest they earn little over 200 € per month; many months go by when they have no income at all. Although these migrants originate from all over North Africa, more than half of them were settled in Libya at the beginning of 2011. Back then they had relatively normal lives, with a real job and proper housing.

I have been writing on Libya and its demise for over six years, studying the implications to our economy and way of life. Behind all these big stories are real lives and great human suffering. All this happens literally in our neighbourhood, and goes largely unnoticed to the general public.

Bitter Oranges is the name of this research project. There is a photo gallery to visit and also a short video to watch.

29 November 2014

Press review 29-11-2014 - The Crash

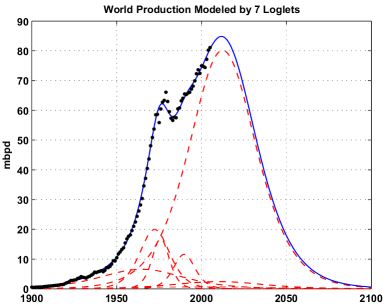

In reality, volumes extracted grew considerably slower than atecipated by this loglets model. Even if it captured accurately the dynamics of the petroleum system, the decline it portrayed was considerably delayed. After all this time, how have the results from the Loglets analysis evolved? Does it portrait a different scenario with further eight data points? This is what this work sets out to answer.

22 November 2014

15 November 2014

Press review 15-11-2014 - Ravished Ukraine

Ukraine is back to the front pages with further escalation of the conflict. Combat intensified and the western media is reporting a large scale invasion of the Donbass by Russian forces. The mere risk a full out war poses on gas infrastructure is disturbing by itself.

There is still no gas flowing from Russia to Ukraine. The European Commission is having second thoughts and is for now refusing to foot the bill. A mild Autumn is supporting this policy, but on the wake of the Russia vilification campaign, leaving the Ukrainian nationalists out in the cold is not really an option.

08 November 2014

Press review 08-11-2014 - Brent is sinking

In a striking sign of times, the Brent petroleum field in the North Sea appears to be fast reaching the end of its economic life. The petroleum extracted from this field has been the benchmarks for about half of all the petroleum traded internationally. Ironically, the benchmark seems no longer able to support itself. Soon the media might have to start referring to a different international price index.

01 November 2014

Press review 01-11-2014 - Nationalism is great in Summer

Sunday, two thirds of Ukraine elected a new Parliament, guaranteeing the permanence of nationalist forces in power. The russophone separatist regions of Luhansk and Donetsk should held their own elections in short order, in spite of having one million refugees in Russia.

The gas supply pre-agreement drafted last week was finally confirmed. Russia dragged negotiations trying to force the EU into a parallel agreement guaranteeing payment on behalf of Ukraine. Such formality did not come to fruition, but it is clear it will be European tax payers largely paying for the gas consumed by Ukraine for the foreseeable future.

30 October 2014

Whatever happened to Ukraine's treasury?

The story of the Ukraine crisis can be told in many ways, but the gas supply is perhaps the most important starting point. Half of the gas that transits from Russia to the European Union flows through multiple pipelines striping Ukraine. The over-dependence of the country on this fuel is above all a convenience, from it obtaining a large share of its heating and electricity.

The story of the Ukraine crisis can be told in many ways, but the gas supply is perhaps the most important starting point. Half of the gas that transits from Russia to the European Union flows through multiple pipelines striping Ukraine. The over-dependence of the country on this fuel is above all a convenience, from it obtaining a large share of its heating and electricity.

The government of Viktor Yanukovich, facing a gripping economic crisis, managed to get from Russia a reduction of the gas price to about half of that paid by costumers in the European Union. But this timely aid had a price: the definitive absorption of Ukraine into the sphere of influence of Russia and the BRICS. Reacting to this re-approximation towards Russia, various nationalist groups united against the government, paralysing the capital, boycotting negotiations with opposition parties and finally taking power in February.

25 October 2014

Press review 25-10-2014 - RIP Christophe de Margerie

|

De Margerie understood like few that resource constraints are as much an opportunity as they are a challenge to the petroleum industry. Petroleum is not running out, rather the easier to extract reserves. This understanding is best reflected in how well the company he lead fared the past decade, par rapport to other multi-nationals.

No wonder then the posthumous praise de Margerie received from most sectors he had been involved with: politics, business, even sports. A real loss in many ways.

18 October 2014

11 October 2014

04 October 2014

Press review 04-10-2014 - The plunge

Short term the biggest risk in Europe remains the gas supply from Russia. News broke out this week of fresh cuts, affecting more member states. Negotiations on a deal over supplies to Ukraine seem to have staled. With storage facilities nearly full throughout Europe this issue does not seem pressing; but there should be no illusions: Europe can not make through the winter without regular supplies.

ReutersThe Russian establishment has been (correctly) vocal in condemning the role played by neo-nazi organisations in the coup d'état in Kiev. That however does not prevent Russian companies from making special deals with Viktor Orban. Apparently, Hungary is breaching a decision took by the European Council. Is it one more defiant step towards an inevitable exit from the EU? Or is Hungary aware of more supply cuts to come?

EU-Russia gas duel deepens with Slovakia supply cut

01-10-2014

The cat and mouse game between Europe and Russia on gas intensified on Wednesday with Slovakia saying its supply from Russia was down by a half and its prime minister calling the move part of a political fight.

Since September, Russia's state-controlled Gazprom has sent less-than-requested deliveries to Poland, Slovakia, Austria and Hungary - after the European Union began sending gas to Ukraine - in a clear warning from Moscow ahead of the winter heating season which officially starts today, when the industry switches to higher pricing.

The 50 percent cut reported by Slovakia, a major transit point for Russian gas exports to Europe, was by far the deepest yet, and Prime Minister Robert Fico said he would call a crisis meeting of his government if the problems persisted.

ReutersRussia keeps on expanding its costumer base, reducing its reliance on Europe. China is a natural partner in a a new drive towards the East, with whom Russia shares one of longest borders in the world. The gas pipelines recently referenced by the press are just the beginning of a large inversion of energy flows from Europe to China.

Hungary to import more gas from Gazprom, says PM Orban

Krisztina Than, 26-09-2014

Hungary has secured increased gas imports from Russia's Gazprom, Prime Minister Viktor Orban said on Friday, a day after Hungary's pipeline operator FGSZ stopped shipping gas to Ukraine.

Orban told public radio that he had held talks with Gazprom CEO Alexei Miller and the company had agreed to ship increased volumes of gas to boost levels at Hungary's storage facilities in the coming weeks.

Hungary is aiming to avert supply problems in the event of a potential halt in shipments of Russian gas stemming from the Ukraine crisis.

New Eastern OutlookRussia is also reportedly on the move to tame hydro-carbon supplies from the Caspian basin to Europe. Is Ukraine really worthy all this?

China and Russia in New Strategic Energy Deals

William Engdahl, 28-09-2014

Only weeks after Russia’s Putin and China’s President Xi signed what was called the “energy deal of the century,” a $400 billion eastern gas and pipeline project over 30 years from Russia to China, the two countries have followed with a dazzling array of major new energy agreements from gas to oil to coal. Taken as a totality it amounts to a major strategic and geopolitical shift in relations between the two giant nations of Eurasia that will have implications for the future of Europe as well as the United States.

[...] The two Russia-China gas pipeline projects are far from all being agreed between the two Eurasian countries at the moment. The deputy head of China’s National Energy Administration, Zhang Yuqing, announced on September 19, just two days after the news of the western Siberia-China talks, that China will “amplify cooperation” with Russian companies on Russia’s huge Yamal Liquified Natural Gas (LNG) project. The Chinese, who have been developing their own technology for creating LNG, will use their technology in the project in Yamal for gas deliveries to China.

[...] At the same time, in early September, the Russian state company, Russian Technologies, or Rostec, signed a $10 billion deal with China’s state-owned Shenhua Group Corp Ltd, the largest producer of coal in the world. It calls for the two to develop coal deposits in Russia’s Siberia and the Far East. The two companies will explore and develop the Ogodzhinskoye coal deposit in Russia’s Amur Region, with estimated coal reserves of 1.6 billion metric tons. Rostec expects coal production to start in 2019, with annual production reaching 30 million tons to be exported mainly to China.

NikkeiThe petroleum price dive made up for contradicting headlines in the press this week. On the one hand were those expecting the world economy to keep struggling, dragging prices further down.

Caspian states fight over oil and gas riches

Jacopo Dettoni, 28-09-2014

As a new regional order emerged in Central Asia from the ashes of the Soviet Union, the five Caspian coastal states recognized the need for an update of the Soviet-Iranian treaties that had regulated the basin since 1921. Russia initially tried to veto any deal involving oil and gas, only to take a step back in the late 1990s, when it agreed to bilateral treaties with Azerbaijan and Kazakhstan that granted sovereign rights over the resources off their coasts.

Although Iran and Turkmenistan never recognized these agreements, the treaties gave Azerbaijan and Kazakhstan legal grounds for the development of oil and gas fields. With the construction of the Baku-Tbilisi-Ceyhan and Baku-Tbilisi-Erzurum pipelines, which came on stream in 2006 and 2008 respectively, Caspian hydrocarbons began flowing from Azerbaijan on the west coast of the Caspian to Turkey, and on to western Europe. Both pipelines are outside Moscow's control.

[...] "Right now (the Russians) have a great foreign policy incentive to try to stop the flow of oil and gas to Europe," said Jim von Geldern, professor of Russian and international studies at Macalester College in the U.S. state of Minnesota. "If they go back to the 1921 convention, they treat the basin more like a lake, which means they have to negotiate any division of resources. If it is negotiation, rather than law, then it is to the advantage of the more powerful countries such as Russia and Iran."

Dmitry Shlapentokh, professor of Soviet and post-Soviet history at Indiana University, also in the U.S., said Russia's main objective is to protect its gas sales to Western Europe from Caspian Sea competition. "Because of that, Turkmenistan and its large endowment of gas resources is a major cause of concern for Moscow. If (Turkmenistan) joins forces with Azerbaijan through a trans-Caspian pipeline, that would pose a serious threat to the Russian monopoly. This is why Russia's priority is to prevent such a pipeline from seeing the light."

CNBCOn the other hand were those acknowledging present prices are not able to sustain many of the petroleum projects online today and the majority of those required in the near future. The key in this debate is timing.

'Perfect storm' could send oil to $75, pro says

Michelle Fox, 02-10-2014

Oil prices will continue to slide down, with West Texas Intermediate possibly plunging to $75 a barrel, Jack Bouroudijan told CNBC's "Power Lunch" Thursday.

"This is a perfect storm for oil, think about it, between the Saudis trying to maintain market share and cutting and slashing prices, between the strong dollar … and the fact is that there is a huge supply out there," said Bouroudijan, chief investment officer at Index Financial Partners and a CNBC contributor.

CNBCSaudi Arabia felt forced to intervene, announcing a cut to its petroleum output. Some investors perceived this move as an end to the price slump, but in parallel to cutting output, Saudi Arabia is also cutting the price to cash deliveries, increasing the discount on the regional Arabian Light benchmark.

Cheap oil 'a mirage' and heading to $140: Dicker

Bruno J. Navarro, 01-10-2014

Brent crude oil prices this week dropped 2.4 percent to $94.83 per barrel and West Texas Intermediate saw a 3.6 percent decline to $91.16 a barrel. Meanwhile, the U.S. dollar hit a four-year high.

On CNBC's "Halftime Report," Dicker called cheap oil prices "a mirage."

"If you put up any chart for any currency you like against the dollar—put up the euro, put up the yen, put up the pound, put up whatever you like—you see a ski slope. And that's really what's been affecting oil," he said. "And that, to me, is a financial connection that is specious at best. When it works, it works. But when it doesn't work, it fails spectacularly. This is one of those moments when it's really working. The dollar continues to get stronger and continues to force oil lower. But I tell you, this is a mirage, and this is why: It's all about future production."

BloombergIn the wake of Scotland's independence vote, further assessments of North Sea resources keep coming. In this particular case, and after working through the usual mess up with units, this reports seems to inform that remaining petroleum in the British offshore will cost at least 66 $/b just in exploration. In between the lines this report is actually saying the end is near, which is not really a surprise.

Worst Seen Over for Crude Prices as Saudis Cut Production

Grant Smith, 01-10-2014

The worst is over for global oil prices, according to UBS AG and Barclays Plc. After the biggest quarterly drop in more than two years, Brent is set to recover as Saudi Arabia cuts output and demand climbs, they said.

“Supply is the important thing and Saudi Arabia is in the process of rebalancing the market,” Giovanni Staunovo, an analyst at UBS in Zurich, said by e-mail yesterday. “The weakness in crude oil prices should come to an end.”

Brent fell yesterday by the most since Jan. 2 to $94.67 a barrel. It extended a quarterly drop to 16 percent, the largest since the three months ended June 2012. The benchmark grade for more than half the world’s oil will average $105 from October to December, according to the median estimate of 15 analysts compiled by Bloomberg since Sept. 11. It was up 0.8 percent at $95.41 a barrel at 10:47 a.m. New York time today.

UPINews of losses on the American source rocks keep flowing, now with petroleum resources frequently referenced. The losses made public by Sumitomo may be the largest yet reported on these resources, and will certainly not be the last.

Huge investments needed offshore Britain

Daniel J. Graeber, 30-09-2014

British offshore oil and natural gas reserves will stop providing a return on investments if costs continue to rise, an industry report said Tuesday.

Oil and Gas U.K., the British industry body, published its annual report Tuesday showing there may be as much as 24 billion barrels of oil equivalent left offshore, but it may require more than $1.6 trillion in investments to exploit.

It warned that operating costs on the British continental shelf were 60 percent higher than they were in 2011.

BloombergA deeper analysis of this case below. Clearly, the potential is there for more losses of this size with operations on these resources.

Sumitomo to Probe $1.8 Billion in Shale And Coal Losses

Ichiro Suzuki and James Paton, 29-09-2014

Sumitomo Corp. (8053) will set up a special investigation into how it lost almost $1.8 billion in Texas shale oil and Australian coal mining.

The probe comes after the company, Japan’s fourth-biggest trading house, cut its annual profit forecast by 96 percent after writing down the value of the two investments. Most of the losses were incurred at the shale oil project it shares with Devon Energy Corp. (DVN) of the U.S.

“I didn’t expect the loss could reach this level at all,” said Jiro Iokibe, a senior analyst at Daiwa Securities in Tokyo, adding that the next threat for shareholders is a possible cut to the company’s dividend.

The Daily ImpactAnd to close the review on petroleum an excellent article diving into the popular debate around Peak Oil. Highly recommended weekend reading.

Shale Oil Boom Breaking Down

Tom Lewis, 01-10-2014

Recent research suggests that fracking causes earthquakes; they have no doubt of that at the fourth largest trading and investment company in Japan — Sumitomo Corporation — which has just experienced a Magnitude 10. The profit Sumitomo expected to make this year, a hefty $2.27 billion, has been all but wiped out. News of the disaster atomized 13 per cent of its stock value in one day. Its credit rating went to “negative.” And almost all of this was caused by hideous losses incurred in fracking for tight oil in Texas.

Sumitomo samurai rolled into Texas just two years ago (seems like only yesterday) with a $2 billion dollar investment in the Permian shale-oil play, in partnership with Devon Energy of Oklahoma. So here we have Japan’s fourth-largest trading company, along with one of the largest US fracking companies, going into the (potentially, according to the oil interests) richest tight-oil basin in the United States in the midst of a tight oil boom. What could possibly go wrong?

Comfort with Uncomfortable ThoughtsCoal is another commodity affected by the present negative economic outlook. That has not yet translated into relief in the internal Indian market, where power companies are still operating with dwindling stocks. Some analysts expect this surge in coal imports to come shortly, leaving a clear mark in the 2015 statistics.

In Search of Oil Realism

Ray Long, 30-09-2014

Let's start at 10,000 feet. One of the key points of my blog is that people get into trouble because they confuse (or purposely confuse) Peak Oil and the Peak Oil Debate, or stated another way, they confuse what Peak Oil IS and what Peak Oil MEANS.

The definition of Peak Oil is the "maximum rate of oil production" - it's a number, nothing more, nothing less. Production of all finite resources eventually reach a peak in production. That's not controversial, it's not scary, it's just a number.

The Peak Oil Debate on the other hand is all the discussion surrounding that number. What will the peak rate be (what's the number)? When will it happen? How do we properly define "oil" (many argue that if you limit the definition to conventional crude, we're already past global peak)? How does the decline look after the peak (steep decline, plateau, et cetera)? What happens to price and costs to the oil industry? What consequences does the peak have for society? And many other questions.

With so many different questions to answer in the Peak Oil Debate, it should be obvious that many different positions exist in the debate. Peak Oil beliefs are not homogeneous - as Robert Rapier points out in his article Five Misconceptions about Peak Oil.

OilPrice.comFollowing a sceptical article on wind energy that is worth the time. It portraits several projects still in the development phase that point were this technology may be heading to in the future.

Analysts Say India's Coal Imports Are About to Explode

Dave Forest, 29-09-2014

As I've discussed, India's coal sector is in crisis. With stalling domestic production leading to rolling blackouts of late--as many of the country's coal-fired power plants struggle to find supply.

As of September 23, a full 35% of the country's coal-powered plants were running at "super-critical" coal supply levels. With less than 4 days of inventory on hand.

And according to a few high-profile analysts this week, that's going to lead to a big jump in imports to fill the gap.

Local coal analysts OreTeam released a forecast predicting that coal imports could leap to 210 million tonnes in the fiscal year 2015/16 (which will begin April 1, 2015).

That would be a significant rise. Up 25%--or over 40 million tonnes--from the 168.4 million tonnes of coal India imported during the last fiscal year.

NBC NewsThe IEA is joining the camp of optimists on solar energy, in the wake of persistent failures to forecast the actual ramp up of electricity generation capacity around the world (it would be great if they could do the same regarding their petroleum forecasts). There is however no word on the spreading drive to make PV illegal in many countries around the world.

Will They Fly? Wind-Power Alternatives Buffeted by Technical Squalls

Miguel Llanos, 27-09-2014

Energy startups are trying to get power where no one has gone before: hundreds of feet up in the air, harnessing wind that blows steadier and stronger than on the ground.

But along with technical challenges that come on the cutting edge of the renewable energy industry, they now must factor in cheap natural gas — an obstacle for all kinds of alternative power technologies, say experts.

BloombergHave a good weekend.

Solar May Become Largest Global Power Source by 2050

Marc Roca, 29-09-2014

Photovoltaic plants may provide as much as 16 percent of global electricity, and concentrating solar facilities could generate another 11 percent, the IEA said in an e-mailed statement today. The Paris-based organization details what is required to reach these figures in two scenarios it sets out to reach the goal.

“The rapid cost decrease of photovoltaic modules and systems in the last few years has opened new perspectives for using solar energy as a major source of electricity,” Executive Director Maria van der Hoeven said.

[...] Photovoltaic installations have grown much faster than the agency expected when it released its first outlook for solar in 2010, when it saw them covering 11 percent of global power by 2050. More solar capacity has been added since 2010 than in the previous four decades, the IEA said.

27 September 2014

20 September 2014

Press review 20-09-2014 - United

In fact, this coming winter could already be the energy event horizon long expected for the UK. To the decline of the North Sea adds the progressive retirement of Coal and Nuclear power plants, that has slowly derided the capacities of the UK National Grid to meet electricity needs. More than a decade of negligent energy policies now translate in to diesel fired electricity generation. The market will certainly deal with the problem, but is this the outcome British citizens wish?

16 September 2014

Scottish independence and the media

13 September 2014

Press review 13-09-2014 - Back in Contango

These economic developments come at the wrong moment for the petroleum industry. Recent reviews have focused on the mismatch between prices and extraction costs, that for some marginal producers may be at this stage in excess of 50%. The sustained price hike necessary to support these producers seems remote at this stage, leaving great doubts over the gargantuan amounts of debt that allowed the industry to operate with prices under marginal cost. If in pasts weeks extra-heavy petroleum and off-shore resources have been the focus of these debt woes, now even the so called "shales" in North America are cast in doubt.

07 September 2014

Scotland independence: the case for Yes

I am not Scottish, nor do I live in Scotland, thus I can not possibly fathom everything driving the vote. But one exercise I can make: assess the economic risks associated with the decision. And by doing so the complexity of this question becomes apparent, as so how uncertain is the outcome.

06 September 2014

Press review 06-09-2014 - The Limits

Contrary to what these journalists assert, I do not find the study to be a doomsday prophecy. The standard scenario is one of various developed, each with a different outcome. The study provided important insights into the mechanisms driving exponential growth and the possible obstacles to its perpetuation. The fact that the standard scenario has been the most accurate these past forty years means that finite resources are the most important of these obstacles, anticipating an end to growth sooner rather that later. And herein lies the path to a sustainable future: replacing finite resources with renewable ones and/or closing the resource extraction - usage - disposal cycle.

30 August 2014

Press review 30-08-2014 - The North Sea End Game

There is not much wealth in a resource that, however plentiful, is a marginal producer, parked at the head section of the supply curve. Yes, there is still petroleum and gas under the North Sea, but these are now mostly low return resources, that - as the article below explains - hardly provide revenues for their own exploration. The moment costs per barrel go above the market price it is all over.

Nevertheless, the sheer political risks associated with either the "yes" or the "no" supersede the budgetary questions and should be the main driver of the Scots' decision.

23 August 2014

Press review 23-08-2014 - American "shale gas" to reach Europe by 2016

Just this week the Portuguese Secretary of State for Energy announced the signing of several contracts between American and European companies to start shipping gas from the former to the latter from 2016 onwards. This gas is to enter Europe through Sines, the westernmost deep water LNG terminal in Europe, with a total storage capacity close to 400 000 m3.

The Secretary of State believes the so called "shale gas" to reach European shores at prices well under those paid today for conventional gas. Nevertheless, his discourse is mostly conditional, repeatedly employing the word "could". Portugal and Spain do not consume Russian gas, having historically relied on Algeria for this fuel. With exports from that country in decline, diversification through LNG is mostly inevitable.

16 August 2014

09 August 2014

Press review 09-08-2014 - Beholding cahos in confort

The IS is now pushing in three different fronts: to the west in Syria, to the north-east against the Kurds and to the south-east against the Shiites; it still holds the initiative in all of these. This is the most serious war of the XXI century, for its barbaric nature, for the large territories it extends to and for the number of countries involved: Iraq, Syria, Lebanon, Iran, US, plus Turkey Jordan and Saudi in high alert.

Remarkably, there is no visible impact on Iraq's petroleum exports. So far the only impact on the comfortable lifestyles of the west are the gory images circulating through the so called social media.

06 August 2014

Ubuntu Shopping Lens deemed legal by UK data privacy office

Throughout the following weeks the row focused on the awkward matching of unsolicited advertisements with free and open source software. In the meantime I started wondering if something far more serious could be at stake. Regarding previous experiences with data collection in my professional career and after carefully re-examining the European Directive on data privacy, I made public a series of concerns that lead me to a mini-saga, and Canonical to consider the matter in a totally different way.

This is a short story of this mini-saga and how it finally came to an end last week.

02 August 2014

Press review 02-08-2014 - Shooting one's toes

Irrespective of whom committed this abhorrent crime, its purpose seems to have been served. It prolongs the war, increases the strain on the European economy and most importantly, puts an end to the efforts towards a peaceful solution to the crisis.

27 July 2014

Press review 27-07-2014 - Canary in the Gold mine

19 July 2014

Press review 19-07-2014 - Raging wars

In Ukraine the conflict deepened significantly with the killing of hundreds of foreign civilians. The western media blames it on the russophone separatists, while the Russian media blames it on the Ukrainian army. As Aeschylus long ago wrote, "truth is the first casualty of war". Along the way, adequate supplies of gas to Europe the coming winter seem ever more menaced.

Apart from Ukraine, Iraq remains the most threatening case to our energy predicament. The picture is starting to look really bleak for the Baghdad government. Lacking foreign intervention a victory in this war seems a remote possibility.

12 July 2014

Press review 12-07-2014 - Peak Oil in Russia

The news meat-grinder has recently been profuse in news regarding the breakaway of the BRICS from the IMF and other OECD controlled institutions. This was a setting trend but that has been accelerated by the backlash of the US spying programme and, more importantly, by the intervention of NATO in Ukraine.

In the midst of all this comes almost unnoticed what is probably the most important energy news of 2014: Petroleum extraction in Russia has definitely peaked. Russian authorities are openly bracing for the ensuing decline in exports and revenues. This was one of the points I recently raised supporting the hypothesis of a return to price volatility.

05 July 2014

Press review 04-07-2014 - Waiting for the impact

Where will it all end? Can the jihadists content themselves with the Sunni territories or will they seek further expansion? Their organisation and capacities do not cease to surprise, how far can they really go?

So far their methods and efficacy have alarmed everyone else in the region, even Sunni majority states such as Saudi Arabia. For us living here in the so called West, life seems to go on exactly as before, but in fact the world has become a different place the past few weeks.

28 June 2014

Press review 28-06-2014 - “Iraq is finished”

The news meat-grinder is still ablaze with Iraq. Day in day out there are reports of Sunni forces lead by ISIL taking another town, another important infrastructure, another border post. ISIL alone seems in control of the whole section of the Euphrates valley between the Turkey-Syria border and the gates of Baghdad. The huge triangle between that valley, the Tigris valley and the Kurdish autonomous region seems also fully controlled by Sunni forces, ISIL or other.

The news meat-grinder is still ablaze with Iraq. Day in day out there are reports of Sunni forces lead by ISIL taking another town, another important infrastructure, another border post. ISIL alone seems in control of the whole section of the Euphrates valley between the Turkey-Syria border and the gates of Baghdad. The huge triangle between that valley, the Tigris valley and the Kurdish autonomous region seems also fully controlled by Sunni forces, ISIL or other.

The reporting by the western media is increasingly contradictory, one day ISIL is in complete control of the Baiji refinery, the following day it is still Baghdad in control. Monday the Sunni are reportedly fighting each other, Wednesday al-Nusra militants are pledging alliance to ISIL. But I reckon that reporting on this story must be anything but easy.

If up to now I considered the threats on Baghdad mostly rhetoric, reported gains by ISIL south of the capital call for reconsideration. It is not clear that ISIL has an army powerful enough to take a city of this size, but its breathtaking advance means it can not possibly be underestimated.

“Iraq is finished,” he said. “Maliki is nothing. Baghdad is finished. Now there will only be a Shiite-stan, Sunni-stan and Kurdistan.”Peshmerga officer to Mitchell Prothero of McClatchyDC.

21 June 2014

Press review 21-06-2014 - A bleak picture

The US confirmed its intentions to fend off the advance of Sunni factions, but naturally nothing was said of the support it has been lending to jihadists in the region. But if coming, these are still small steps, no relevant military actions are foreseen in the short term. One of the reasons floated by the US media for this hesitation is a lack of intelligence regarding the geographic lay out of the Sunni command hierarchy. Quite ironic, one year after Edward Snowden's revelations - it seems the US has wired the whole world, except for those that really matter wiring.

On the field there are now reports of shortages of refined products; the impacts of this war are definitly coming.

18 June 2014

Extracted - the trailer

Not so clear what the methane tap is doing there, but appart from that the video is quite good. This book is an essential piece of the economical and environmental puzzle we live these days; naturally highly recommended. Beyond Ugo's remarks on the cost of source rock fossil fuel resources I'd also note the vast artificial inflation of reserve estimates uncovered recently. Certainly something not in the fix toolbox.

14 June 2014

Press review 14-06-2014 - ISIL launches its Fall Gelb

The usual western media branding of "terrorism" or "sectarian violence" no longer applies to the actions of ISIL in Iraq. A force capable of withstanding and win an urban battle in a city of over 1 million inhabitants is not a terrorist group, not even a guerilla, it is an army, fighting a conventional war. In a week it took two entire provinces of the country: Nineveh and Saladin, amounting to an area the size of Latvia and home to almost 2.5 million folk. Although accurate information is scant, ISIL should now be in control of at least 15% of Iraq's petroleum exports. At the time of this writing ISIL is still expanding its attacks into at least the provinces of Diyala and Sulaymaniyah.

07 June 2014

Press review 07-06-2014 - A turning tide

Perhaps most relevant in this strain of news was a publication by the IEA concluding on the need for investments in the order of 50 T$ to maintain the energy system afloat the next 20 years (almost half of it in the petroleum sector). This would be the equivalent of investing the entire GDP of the UK every year up to 2035. In real life international companies are divesting in exploration, scrapping risky developments and selling assets; raging wars in Africa and the Middle East impair infrastructure in several key petroleum exporting countries. At this stage it is not easy to envision how these needs can be met.

03 June 2014

Five reasons to expect volatile petroleum prices to return

In the same period extracted volumes remained too within a narrow band, between 74 Mb/d and 77 Mb/d. Long civil wars in Libya and Syria removed well over 1 Mb/d from the market, with economic sanctions on Iran also having a negative impact. But extraction from source rocks in the US and tar sands in Canada made up for these losses, with a shy output increase in Iraq also helping.

But for how long can this quiet market last? Apart from Iran, the internal politics of every other OPEC member seems deteriorating. Unconventional resources have so far plugged the gap, but can present prices sustain their expansion? In fact there are a few clues pointing to an end to this market sooner rather than later.

31 May 2014

Press review 31-05-2014 - More "shale" jitters

The revision to these source rock reserves came at a specially critical moment. OPEC faces all sorts of political constraints to petroleum extraction; meanwhile NATO plays games with Russia, the world's largest petroleum producer. These past few years have been characterised by remarkably stable prices and a dynamic market, but can it last under present circumstances?

27 May 2014

Woes of a bike commuter

Some years ago the Luxembourgish steel company - ARBED - was sold to Lashki Mittal, who hastily dismantled the whole complex, moving entire furnaces to Asia. Acknowledging the demise of the steel industry, the Luxembourgish government designed a programme to replace it with an academic village, hosting a university, several research centres and a company incubator in an old industrial park in a place called Belval.

With works drawing to a close, the Tudor offices where I work were moved to Belval one year ago. I am no longer in walking distance, but the 4.5 km of bike lanes linking Esch-sur-Alzette to Belval make it perfect for bike commuting. Little would I know that this short ride would be anything but simple.

24 May 2014

Press review 24-05-2014 - "Shale oil" blues

There is a lot here to think about. How could have the original estimate been so wrong? How could have it prevailed long enough to become a relevant part of energy policy in California? What happens to the companies that had already positioned themselves to exploit a resource that is now known to be largely unexistent? How trustworthy are other petroleum (and gas) estimates issued by the authorities in the US?

Policy makers in Europe beware. What happened in Poland regarding source rock gas reserves indicates too that these overestimations may be more norm than exception.

17 May 2014

Press review 17-05-2014 - The undercovered

As alluded in previous press reviews, there seems to be foreign agents on the field playing an important role in the course of events. This week the German press is reporting the presence of some 400 American mercenaries in Ukraine engaging the separatists. One has to wonder what was the role of this force in the massacre in Maidan square and more recently in Odessa.

10 May 2014

Press review 10-05-2014 - Progress on Ukraine

But on the field tension among Ukrainians keeps mounting. The death toll is now reported on the tenths, after the massacre of over 50 russophones last weekend. Some communities appear especially restless, demanding no less than independence. It is hard to see how any valid democratic process can take place in this setting.

Meanwhile the governors put in Kiev after the coup d'état started to get funds from the IMF; they should now be able to keep paying for the gas they get from Russia.

03 May 2014

Press review 03-05-2014 - Extracted

Two years ago Ugo Bardi invited me to take part in the redaction of a book on raw materials. I spent much of the 2012 summer researching and writing to produce a chapter on two particular metals: silver and gold. After a first edition in German language last year, the English version has finally arrived, to what appears to be a warm reception.

Two years ago Ugo Bardi invited me to take part in the redaction of a book on raw materials. I spent much of the 2012 summer researching and writing to produce a chapter on two particular metals: silver and gold. After a first edition in German language last year, the English version has finally arrived, to what appears to be a warm reception.

"Extracted" provides an overview on the relationship between our society and economy and the stocks of raw materials found in the Earth's crust. These stocks are sources of negentropy - negative entropy, meaning organised or concentrated matter, as opposed to chaos and dispersion - that feed our industries with low cost inputs. The economic difficulties we live today are closely linked to a decline in the quality of the resources needed to feed our economies - meaning an increase in entropy - that may at some point even translate into a decline of extraction rates.

01 May 2014

The First Presidential Debate

Better late than ever. After 60 years of EU, European elections have finally faces to match the insignias. In great measure due to internal youth movements, European political parties where forced one by one to present a candidate to the post of European Commission President. Euronews took the chance and invited the candidates for the first ever presidential debate in the history of the EU. In an university auditorium packed with students and the door open to citizen participation through the internet, the stage was set for a unique moment in the 28th of April.

Better late than ever. After 60 years of EU, European elections have finally faces to match the insignias. In great measure due to internal youth movements, European political parties where forced one by one to present a candidate to the post of European Commission President. Euronews took the chance and invited the candidates for the first ever presidential debate in the history of the EU. In an university auditorium packed with students and the door open to citizen participation through the internet, the stage was set for a unique moment in the 28th of April.

Below the fold is a brief analysis of the performance of each candidate.

26 April 2014

Press review 26-04-2014 - The IPCC Cornucopia

Nebojsa Nakicenovic was present at the 2012 ASPO conference in Viena. He is responsible for the forecasts produced at the IIASA to be used by the IPCC and IEA. The Q&A after his presentation was remarkable, not all that different from talking to a rock. He kept insisting the reserves figures he uses are backed by peer review literature and as soon as his session ended left the building in haste. With this latest report it becomes obvious that the IIASA (and the IPCC) are in fact ignoring the growing number of peer reviewed studies with realistic fossil fuel reserves assessments.

The persistent failure of the IIASA forecasts have forced the IEA to use alternative scenarios for the short term, but long term they are still used for CO2 emissions. These are also the scenarios used by pretty much every government of OECD. They are, unfortunately, the best example of demand side energy modelling, brilliantly exposed by Steven Kopits some months ago.

12 April 2014

Press review 12-04-2014 - Russia calls the bluff (2nd edition)

This week Russia has passed on the offensive over Ukraine. The Russian press issued clear hints of a definitive move away from the US dollar in the country's foreign economic relations. These news frame these actions within the design of a new world monetary system, together with the remainder of the BRICS. And Thursday came a letter furnished through diplomatic channels to 18 European leaders simply stating that if no one is willing to foot the bill for the gas Ukraine gets from Russia valves will be eventually closed.

Meanwhile Kiev seems to go from bad to worse, with Parliament paralysed and political institutions disaggregating. In eastern regions of the country unrest grows, russophone populations disprove the coupe d'état and are weary of the political and economic disarray the country has fallen into. In spite of repeated claims of a Russian military build up along the Ukraine border by the western media, Russia does not seem that willing to get further involved in the field, at least for now. The fact to no one is clearly taking responsibility for the survival of Ukraine may actually be the problem at this stage.

05 April 2014

Press review 05-04-2014 - Back to Iraq

And the deeper question is why has the western media been silent on this? More important than the propaganda feed us everyday is what is left told, opinion control through censorship. Luckily today there's the internet, that allows for diligent citizens to seek out information and the broader picture.

03 April 2014

A story of TheOilDrum

This post is a story of TheOilDrum, as I lived it. It is a collection of loose memories patched together into some sort of chronological order. Memory is not fully reliable, same dates or periods may not be precise. This is above all a personal account of the most important events during the website life time.

This post is a story of TheOilDrum, as I lived it. It is a collection of loose memories patched together into some sort of chronological order. Memory is not fully reliable, same dates or periods may not be precise. This is above all a personal account of the most important events during the website life time.

Certainly a lot is left untold. I was never part of the editorial or administrative boards, thus plenty of the behind scenes events escaped me. The same story told by someone else will surely be different. In spite of being a personal retrospection, I hope it can still provide an holistic view of what TheOilDrum was and point the potentials that this fantastic experiment unleashed.

This post has been in the making for long. The idea came up immediately after the announcement of the website closure, but other commitments kept it at bay. The ninth anniversary of TheOilDrum foundation passed just weeks ago, but still not that late to celebrate. Grab a portion of your favourite ingestible liquid and let yourself go in this journey through time.

29 March 2014

Press review 29-03-2014 - Propaganda

One of the remarkable outcomes of this crisis is the revival of the transatlantic trade agreement. The multiple espionage scandals related to the activities of the American and British intelligence agencies had put negotiations on hold, the European companies being in clear competitive disadvantage with their information harvested en masse. This is the first big victory of the US in this crisis, and might not be the last.

22 March 2014

Press review 22-03-2014 - The gas play

Thus to harsh words follow puny actions against Russia, to the bemusement of the Kremlin. In spite of the pressures from the US and the UK, Europe will continue to do all it can to maintain business as usual with Russia. The intents of "political isolation" are not much more than rhetoric, in a world where the West weights less and less.

19 March 2014

An Introduction to LaTeX

Some weeks ago I administered a short introductory course on LaTeX to a few of my colleagues. Most of them had never seen anything other than Word, but it went quite well nonetheless. Here below I reproduce the contents of this course.

08 March 2014

Press review 08-03-2014 - Europe caught in the middle

So far NATO has reacted to Russia with sanctions, the US and the UK succeeding in their pressure on the EU to follow their hard stance. Make no mistake, Europe will be the big looser in this stand-off, neither Russia nor the US stand to loose as much. This is the reality of the XXI century, resources have a completely different role in international relationships and conflicts. If for Petroleum and Coal the EU can recur to the international market trying outbid other major importers, the scenario is completely different regarding Gas. If the pipelines out of Russia are tapped off there are no means to replace their flows.

01 March 2014

Press review 01-03-2014 - Ukraine plunged into uncertainty

Beyond the political aspect of this story, there is a much more relevant energy background that is not fully surfacing to the mainstream. Two thirds of the gas the EU gets from Russia flow through Ukraine; gaining influence over Kiev's government means above all taking up the bill for maintaining the country's gas infrastructure. The scrapping of a trade agreement with the EU, that eventually brought the protestors to the streets, was nothing less than a counterpart for continued financial support to Ukraine's banks and infrastructure from Russia. Those thinking that a Greece like IMF intervention suffices to sway Ukraine towards the EU think ill.

23 February 2014

Supply side energy modelling with Steven Kopits

Some hours ago I had no idea who Steven Kopits was, much less the kind of work he has been doing. During the past week I received several times a link in my mailbox to a presentation of his at Columbia University. Last evening I finally found the space to give it a look and ended up watching the whole thing through. It is somewhat unexpected to get this sort of view from someone pretty much at the core of the industry, but you can not be a successful strategist basing your analysis on fairy tales.

Pity though that Steven Kopits falls into the common confusions between production and supply, consumption and demand. Nevertheless, he bluntly dismisses that mathematical and economic aberration termed "peak demand". Aside that I have no other criticisms, this is the best presentation on the petroleum market I have seen in a few years. Sharp remarks on the lack of consumption growth in China are enough to leave the demand side modelling out in the open for the hoax it is.

The video is below the fold. Jump to the Columbia University website for the presentation document and further information on the event.

22 February 2014

Press review - 22-02-2014 - Copper in the mainstream

Beyond putting a date to a peak the most important is price. This past decade copper prices advanced 500% while production volumes have merely moved. It might be very possible for production to continue increase for decades to come, but at what price? Is any economy sustainable with copper at, say, 1000 €/t?

15 February 2014

Press review 15-02-2014 - 90% renewable electricity possible today

In spite of the negative press renewable energy sources receive, their dominance in the supply to Portuguese households hasn't meant high prices. Electricity rates were kept artificially low throughout the last decade, masking a tripling of coal and gas prices. A slow adjustment to cover the deficit created during those years translates into rates today in the order of 0.14 €/kWh, on par with the European average and, for instance, with France, a country that generates most of its electricity from nuclear. Electricity prices in Portugal should peak somewhere between 0.15-0.16 €/kWh still this decade, to then entail a slow decline as fossil fuels phase out of the electrical mix.

08 February 2014

Press review 08-02-2014 - German government scrambles to protect electricity suppliers from cheap PV

In a ditch to save these traditional electricity suppliers - large multinational companies that employ ex-ministers and ex-parliament members at large - governments are scrambling to change the rules of the game. Imagine that every time you cooked at home you would be obliged to pay McDonalds a fee - that's exactly what the Spanish and German governments are trying to impose. Note that in each of these countries the initiative is being taken by supposedly opposing parties: conservatives in Spain, social-democrats in Germany. I can't possibly see how such legislation can comply to market laws, not even speaking of human rights. I expect long and spectacular legal battles to follow.

01 February 2014

Press review 01-02-2014 - Petroleum majors struggling

The first observation to take is the progressive concentration of remaining cheap petroleum resources in a limited number of countries: Middle East, Russia and little else. Perhaps light petroleum resources are left in the Arctic, but these won't come cheap either. Another conclusion is a likely world wide slow down in exploration activity; barring the resurgence of Iraq in the market this could bring forward relevant price movements in the years ahead.

25 January 2014

Press review 25-01-2013 - Iraq desintegrating

A new front of conflict opened to the north with the Kurdish autonomous region, even if in this case it is purely political. The Kurds are set to bypass the Baghdad government and export petroleum solely by themselves. This can actually be more concerning to the Shiia establishment than the rebellion in Anbar.

For how long can Iraq's petroleum production stay where it is today?

18 January 2014

Press review 18-01-2014 - Iran back to business

The Shiia now seem to have the favour of the US (and NATO) west of the Euphrates. With some cooperation, the western powers prefer to deal with Shiia hierarchies than with the conservative Sunni structure (often "linked" to Al Qaeda by the media). Why the attitude is pretty much the opposite elsewhere remains something of a mystery.

11 January 2014

Press review 11-01-2014 - ISIL expands its territory

The territory controlled by the ISIL according to the Wikipaedia.

The territory controlled by the ISIL according to the Wikipaedia.

|

The information coming out of the newly acquired territories by the ISIL in Iraq is scant, but the western media has still managed to join the fray. Earlier this week the American media was reporting that "tribesmen" where helping the Iraqi army fighting the ISIL; days later the French press claimed that "tribesmen" had helped the ISIL taking full control of Fallujah.

The slowness of the Shia-led government to fight back may mean on the one hand that the local population is not on their side and on the other that the ISIL may have more resources than reported by the mainstream media. One remarkable aspect of this conflict is that so far it has produced a relatively limited number of refugees, 15 000, when compared to the estimated 320 000 living in Fallujah alone.

04 January 2014

Press review 04-01-2014 - Iraq falling into civil war

There is just one problem: Iraq is not a real country, it is but a synthetic creation, a legacy of colonial times disregarding any ethnic or cultural realities. The insistence on this format by modern powers seems reaching exhaustion, after a decade of violent power reshuffling. Earlier this week the Sunni representatives quit the Iraqi parliament, delivering the final blow to an already politically moribund government.