The western media remains largely reluctant in reporting this aspect of Turkey's involvement in this war, and even goes as far as claiming that Daesh is actually selling petroleum to its Shiite foe in Syria... Even the claims on CO2 are more credible.

There has not been a week like this in quite a while, with relevant developments on almost every front. The world seems erupting and energy plays a central role, as always. Most remarkable this time is the rise in geo-political tension meeting a deeply depressed energy market.

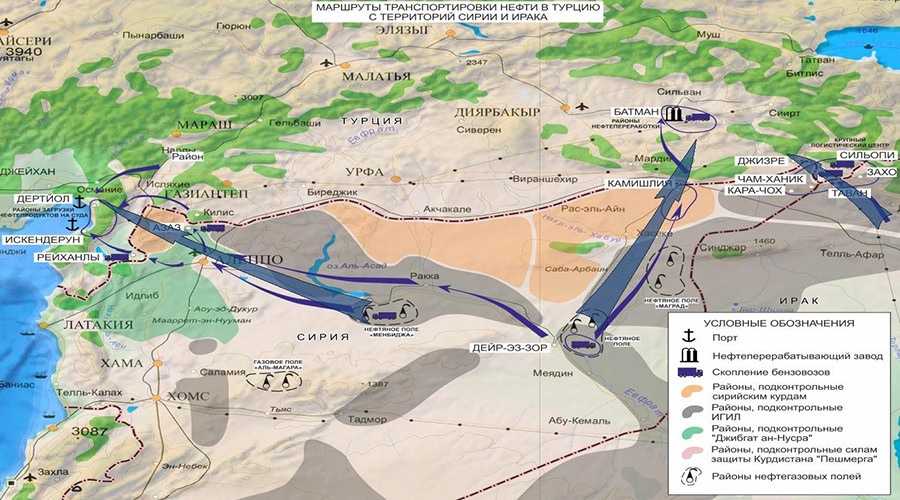

Consortiumnews.comThe Russian military made public a series of data corroborating these old claims of trade between Turkey and Daesh. Most of this petroleum is crossing the Iraq-Turkey border, but some of it is portrayed as entering Turkey from Turkmen controlled territories - over which the Russian Su-24 was shot down.

The Collision Course in Syria

Daniel Lazare, 28-11-2015

With Turkey downing a Russian Su-24 warplane along the Turkish-Syrian border this week, dire predictions about the dangers of escalation in the Syrian conflict are coming true. Events are spinning out of control as Syria turns into a happy hunting ground for military forces locked on a mutual collision course.

Up to 50 U.S. Special Operations troops are due to enter Syria shortly in support of a hastily assembled Arab-Kurdish coalition that could easily come under Russian or Turkish attack. The U.S. is stepping up its bombing raids, destroying another 238 ISIS fuel trucks in eastern Syria last weekend. Russia is targeting tankers plus an ISIS training camp in Idlib in Syria’s far north, while France has also upped its bombing campaign since Nov. 13 in response to ISIS claiming credit for the terror attacks in Paris.

If Turkey seemed to be holding back from joining the fight against ISIS, the fact that ethnically-related Syrian Turkmen villagers have come into Russia’s line of fire – as part of Moscow’s broader attack on Islamic militants seeking to overthrow the Syrian government – may have been a significant factor in persuading Turkey to enter the fray by shooting down the Russian plane.

So, Turkey is fighting the Russians and Kurds, who are fighting ISIS, which is fighting the Syrian government plus Hezbollah and Iranian forces. ISIS has also blown up a Russian tourist flight over the Sinai, set off suicide bombs in Beirut and shot up civilians in Paris. It’s a three- or four-way brawl that grows more chaotic by the week.

Russia TodayClaims that Turkey is backing Daesh and other jihadists in the region are almost as old as the war itself. Fighters, weapons, money, medical treatment, training camps, Turkey as long been reported as a jihad logistic rearward.

Map, images from Russian military show main routes of ISIS oil smuggling to Turkey

02-12-2015

[...] “In total, in their illegal oil smuggling business, terrorists are using at least 8,500 trucks to transport up to 200,000 barrels of oil every day.”

He added that the vehicles with illegal oil that are crossing Turkey are not checked at the border.

“The presented photos, which were taken this August, demonstrate hundreds of oil trucks and heavy vehicles moving both to and from the Turkish border.”

Rudskoy concluded that most of the oil is being transferred from eastern Syria to a large oil refinery plant in Batman, 100km from the Syrian border.

The 200,000 barrels of oil that Russia says is smuggled by IS every day is roughly equivalent to the average daily oil export of Gabon in 2014 or Australia in 2013, according to an OPEC annual statistical bulletin.

SputnikTurkey's actions are having the positive effect of bringing under the spotlight the main question in this conflict: what are exactly NATO's intentions?

Iraqi Politician Claims Turkey Lets ISIL Sell Oil for Meager $20 a Barrel

28-11-2015

In a statement posted on his Facebook page al-Rubaie, who is also a leader of the Law-Governed State parliamentary coalition, outlined Ankara’s four-pronged support for the Islamic militants, with the illegal oil trade topping the list.

“First and foremost, the Turks help the militants sell stolen Iraqi and Syrian oil for $20 a barrel, which is half the market price,” Mowaffak al-Rubaie wrote.

[...] “Each month hundreds of radicals cross the Turkish border, while the local law enforcers pretend they just don’t see,” Mowaffak al-Rubaie wrote, adding that many wounded ISIL fighters were apparently undergoing treatment in Turkish hospitals.

AntiWar.comAs noted last week, in the short term, the most important outcome from this coming out by Turkey is the abrupt end it puts to the so called "Turkish Stream". Another gas route from Russia to Europe is disrupted unexpectedly. Is it just bad luck?

The Phony War on ISIS

Justin Raimondo, 30-11-2015

The downing of a Russian warplane by the Turks raises several questions, which can all be rolled into one big one: In the war against ISIS, which side is Turkey – and NATO – on, anyway?

Now let’s list the subordinate issues that cause us to question what’s really going on in Syria:

- How can the Turks claim they didn’t know it was a Russian plane they were shooting down?

- If the incident was an error on Turkey’s part, why are they refusing to apologize?

- Even if we accept the Turkish version of events – that the Russian plane drifted into Turkish airspace for a grand total of nineteen seconds – how does this justify their action?

- Did the Turks act alone, or did they get the green light from NATO?

- Are the Turks buying oil from ISIS?

GlobalResearchThe war in Syria and Iraq is mingling increasingly with that of Libya. In spite of some setbacks, Daesh is clearly on the rise in the Mediterranean and new information points to a remarkably close connection to the attacks in Paris.

Impacts of Turkey’s Aggression against Russia. The “Turkish Stream” is Dead. Disruption of Gas Pipeline Routes to the EU. Russia’s Economy in Crisis?

Michel Chossudovsky, 27-11-2015

The South Stream was replaced by the “Turkish Stream”. The scrapping of the South Stream was coupled with the signing in Ankara of a historic December 2014 deal between presidents Vladimir Putin and Recyyp Erdogan.

Under the Russian-Turkish agreement pertaining to gas pipeline routes, Turkey was slated to become a major hub and transit route for the export of Russian natural gas to both Southern and Western Europe.

Russia’s Gazprom in a historical announcement by CEO Alexey Miller in January 2015 confirmed that: The Turkish Stream gas pipeline project was considered “the sole route for Russia’s future supplies of 63 billion cubic meters of natural gas to Western Europe… The Gazprom head made this statement in response to a question about the fate of Russia’s South Stream gas pipeline project.”

Consortiumnews.comAn in the midst of all this, petroleum prices declined further this week, breaking under the 2009 lows. Yesterday OPEC convened in what was labelled a "chaotic" meeting. The cartel seems largely inoperative at present.

How Gaddafi’s Ouster Unleashed Terror

Jonathan Marshall, 30-11-2015

Among the many extremist groups running wild in Libya today is the Islamic State (also known as ISIS, ISIL or Daesh). Headquartered in the city of Sirte — the late Col. Gaddafi’s hometown on the central Mediterranean coast —the ISIS colony now hosts as many as 3,000 foreign fighters who enforce their iron rule over a 150-mile stretch of the country’s coast. ISIS also has a strong presence in northeastern Libya, around the towns of Derna and Benghazi.

Since Gaddafi’s fall in 2011, Libya has exported thousands of its own extremists to support jihad in other countries. In Syria, one group of Libyan supporters of ISIS went by the name of Katibat al-Battar al Libi. One of its leaders was none other than Abdelhamid Abaaoud, the suspected organizer of the recent Paris attacks.

His connection to those Libyan fighters in Syria was first established back in January, before the killings in Paris, by Belgian researcher Pieter van Ostaeyen. On Jan. 15, Belgian police killed two members of the radical organization in the town of Verviers, where they were said to be planning a major terrorist attack.

Financial TimesThis depressed petroleum market has lasted over a year and its impacts are increasingly severe. Hardly any player is safe at 43 $/b. When it happens, the rebound from here can be quite spectacular.

Opec meeting ends in acrimony

Anjli Raval, David Sheppard and Neil Hume, 04-12-2015

Opec will stick with its policy of not constraining output and has all but abandoned its official production target at its semi-annual meeting, risking a further drop in oil prices that are currently close to six-year lows.

After a marathon seven-hour session that ended in chaotic scenes outside the Opec secretariat in Vienna, the only agreement reached by the cartel members was to meet again in June.

The group’s official communiqué made no mention of its existing output target of 30m barrels a day, saying only that it would continue to “closely monitor developments’’.

“We cannot put a [production] number on it now,” said Abdalla El-Badri, Opec secretary-general, after the meeting. “Iran is coming back. So we decided to postpone the decision until the next Opec meeting, when the picture will be clearer.”

OilPrice.comThe Shale sub-prime story is now a regular feature in most of the media, even in the mainstream. The predictions are all more or less the same, only the words differ: "collapse", "storm", "bomb", and so on.

Oil Bust Kills Off 19 Million Barrels Per Day Of Future Oil Production

Charles Kennedy, 03-12-2015

The collapse in oil prices have led to severe cuts in spending and investment from oil producers, and a new report finds that the combined cuts will lead to a daily 19 million barrels of potential future oil production taken off the table.

The report from Tudor, Pickering, Holt & Co. finds that oil companies have either cancelled or suspended final investment decisions on 150 oil projects, which account for about 125 billion barrels of oil. “By not sanctioning projects today, you’re putting a hole in production in 2017, 2018 and 2019 — potentially a big hole,” David Pursell, managing director of macro research investment bank Tudor, Pickering, Holt & Co.

Financial TimesThe numbers are looking increasingly ugly, clearly pointing to an impending shock to the US bond market.

US shale: calm before the storm

03-11-2015

Much of the energy debt issued in previous years lacked the protection of covenants and with the participation of hedge funds and private equity, producers could find creative financing structures to ride out the bust. Since 2014, the two heaviest months of bond issuance by US oil and gas were February and March of this year.

Finally, however, the reckoning is nigh. As of the end of November, two-thirds of bank loans among the S&P oil and gas index were trading at distressed levels, compared with just 13 per cent in May. Fitch notes that its trailing 12-month default rate of 5 per cent through October is the highest since 1999. With monetary policy set to tighten, and the US debt markets already feeling the effects, Saudi may be feeling some vindication. Cutting its own production, however, would be an strange way to celebrate.

Wolf StreetNot only at the macro-scale of the bond market are the numbers ugly. Companies' account books are quite telling themselves.

“Distress” in US Corporate Debt Spikes to 2009 Level

Wolf Richter, 02-12-2015

[...] This chart shows the deterioration in the S&P distress ratio for junk bonds (black line) and leveraged loans (brown line). Note the spike during the euro debt-crisis panic in late 2011:

The oil-and-gas sector accounted for 37% of the total distressed debt and sported the second-highest sector distress ratio of 50.4%. That is, half of the oil-and-gas junk debt trades at distressed levels! The biggest names are Chesapeake Energy with $7.4 billion in distressed debt and Linn Energy LLC with nearly $6 billion.

Energy IntelligenceAnother worrying point: the few American companies that called for bankruptcy protection have failed to re-structure.

Debt Bomb Ticking for US Shale

Paul Merolli, November 2015

The US E&P sector could be on the cusp of massive defaults and bankruptcies so staggering they pose a serious threat to the US economy. Without higher oil and gas prices — which few experts foresee in the near future — an over-leveraged, under-hedged US E&P industry faces a truly grim 2016. How bad could things get and when? It increasingly looks like a number of the weakest companies will run out of financial stamina in the first half of next year, and with every dollar of income going to service debt at many heavily leveraged independents, there are waves of others that also face serious trouble if the lower-for-longer oil price scenario extends further.

"I could see a wave of defaults and bankruptcies on the scale of the telecoms, which triggered the 2001 recession," Timothy Smith, president of consultancy Petro Lucrum, told a Platts energy conference in Houston last week. Much has been made about the resiliency of US oil production in the face of low prices, but the truth is that many producers are maximizing their output — even unprofitable volumes — because they need the cash flow to service their debt (related). "As an industry, we're at the point where every dollar of free cash flow now goes to paying back debt," Angle Capital's Steve Ilkay told the same conference. Ilkay, who advises North American producers on asset management, said during the boom years of 2012-14 about 55% of the sector's free cash flow, which is calculated by subtracting capital expenditures from operating cash flow, was allocated toward debt repayment.

Economic TimesWhile investors flee the US market, they now queue up to enter or return to Iran. It is unclear how many of these projects are feasible at 43 $/b. The easy petroleum Iran once had is now mostly gone; achieving the 5.7 Mb/d target will certainly require tapping lower EROEI resources, such as those under the waters of the Persian Gulf.

US oil companies' restructuring plans flounder as prices plunge

01-12-2015

[...] In the past 16 months, the price of oil has sunk to around $40 per barrel from about $100, ending years of elevated crude prices that fueled oil companies' debt-financed expansion.

"It can be a really tough spot especially when you have the bottom drop out," said Michael Cuda, a bankruptcy lawyer with Squire Patton Boggs in Dallas, who represents a lender in the Samson case. "A lot of assets suddenly become valueless," he said, speaking of energy companies generally.

[...] Many of the energy companies now in Chapter 11 are among the weakest players, but their experience serves as a warning that the dozens of their peers struggling to remain afloat may find their assets quickly depleted in bankruptcy, dishing out heavy losses to investors.

[...] Quicksilver Resources Inc entered bankruptcy in March and in September presented creditors a turnaround plan, according to court documents. Yet two weeks later the oil-and-gas producer changed course, saying rapidly dwindling assets forced it to sell its business.

BloombergThese news have been rather prevalent in Portugal these days: for the first time a Brasilian president is facing an impeachment process. As the country dives further into political turmoil, the most likely necessary bail-out to Petrobras looks ever more in jeopardy.

Oil's Big Players Line Up for $30 Billion of Projects in Iran

Golnar Motevalli, Anthony Dipaola and Hashem Kalantari, 28-11-2015

Total SA, Royal Dutch Shell Plc and Lukoil PJSC are among international companies that have selected oil and natural gas deposits to develop in Iran as the holder of the world’s fourth-largest crude reserves presents $30 billion worth of projects to investors.

[...] Iran is pitching 70 oil and natural gas projects valued at $30 billion to foreign investors at a two-day conference in Tehran as the Persian Gulf country prepares for the end of sanctions that have stifled its energy production. All banking and economic sanctions will be lifted by the first week of January,” Amir Hossein Zamaninia, deputy oil minister for international and commerce affairs, said at the event.

[...] The country plans to boost total oil output capacity to 5.7 million barrels a day by the end of 2020, with the help of new production contributed through new energy contact models, Roknoddin Javadi, managing director of state-run National Iranian Oil Co., said at the event. The figure includes both crude and condensate output, he said. Iran pumped 2.7 million barrels a day in October, according to data compiled by Bloomberg.

BloombergThere is an old saying in Portuguese that goes like "I do not believe in witches, but they surely exist!" That is a most appropriate remark to the odd news breaking from the infinite growth, business-as-usual mainstream view of the planet.

Brazil Goes From Crisis to Crisis as Impeachment Bid Begins

Arnaldo Galvão, Mário Sárgio Lima and Anna Edgerton, 02-12-2015

Even in Brazil, a country that is no stranger to crisis, the recent, rapid-fire succession of financial, economic and political blows has been breathtaking.

After a week in which the nation’s top young financier was thrown in jail alongside a senator -- pushing his bank into a struggle for survival -- and Goldman Sachs Group Inc. warned the economy was slipping into a full-blown depression, impeachment proceedings were initiated late Wednesday against President Dilma Rousseff.

Though the hearings will ultimately center on whether Rousseff violated fiscal laws, the root of her widespread unpopularity is the same that landed the banker, Andre Esteves, in jail and crippled the economy: an unprecedented corruption scandal that’s hamstrung the country’s biggest companies and triggered policy paralysis in the capital city. With gross domestic product now shrinking at an annualized pace of almost 7 percent and the budget deficit swelling to the widest in at least two decades, Brazil’s currency and local bond markets have posted deeper losses than those of any other developing nation this year.

Economic TimesInteresting numbers on the Chinese steel sector, that point to where Coal extraction and consumption is headed in the Middle Empire. Once more it becomes apparent the decade of growth China experienced after accessing the World Trade Organisation is unrepeatable.

India’s crude oil output to continue to fall despite government’s efforts: IEA

Sanjeev Choudhary, 01-12-2015

India's crude oil production will continue to fall in the next quarter century despite the government's ambitious targets, declining to less than half the current output as new reserves fail to compensate for the decay in existing fields, the International Energy Agency has said.

The Modi government has set a target of cutting oil import dependence by 10 per cent in next seven years as it hopes to reverse the decline in domestic oil output through a slew of policy measures, fresh investments and technological interventions.

But the Paris-based agency has poured cold water over the government's plan, underlining in its 'India Energy Outlook' report that low-quality reserves and insufficient policy responses will make the country more dependent on imports. By 2040, India's imports will rise to 90 per cent of the overall oil demand, from 70 per cent at present, according to the IEA.

Financial TimesAnother bit of news that is leaving visible impacts in the Lusophone world. Abengoa has already proceeded with massive lay-offs in Brasil and Angola, and is leaving a number of Portuguese banks in distress. There is now talk of a bail-out from the Spanish government - a huge irony since Mr. Rajoy's office has been the most anti-solar government in Europe.

Losses mount in China’s overcrowded steel sector

Gabriel Wildau, 04-12-2015

China’s biggest 101 steel companies, which helped fuel the country’s industrial revolution and housing frenzy, lost a combined Rmb72bn ($11bn) in the first 10 months of 2015, or more than double the profits garnered last year.

The reversal in fortunes highlights the unwinding of rapacious demand for basic materials — in just two years the country produced more cement than the US did in the entire 20th century — as economic growth slows.

[...] China has shuttered 50m tonnes of steel manufacturing capacity this year, just 4 per cent of its total 1.14bn tonnes of capacity, according to HSBC. The bank calculates China would need to cut an additional 120m to 160m tonnes of capacity next year for the industry-wide utilisation rate to reach a “relatively healthy” level of 80 per cent.

BloombergA decade after going from Petroleum exporter to importer, Egypt makes progress with its plans for a Nuclear fleet. The lengths at which Russia is involving itself in this programme are one more lesson for Europen leaders to learn.

Abengoa, the Teetering Sun King of Spain, Prepares for End Game

Luca Casiraghi, 01-12-2015

[...] The then-Spanish King Juan Carlos traveled to Seville in September 2009 to christen the solar-energy company’s new headquarters, designed by renowned architect Richard Rogers’s firm. Aggressive growth plans helped Abengoa sell more than 1 billion euros ($1.1 billion) of bonds in a few months. A little while later, it won a $1.5 billion loan guarantee in the U.S. to build a solar plant in Arizona.

In the years that followed, Abengoa, founded as an electrical company in the Andalusia region more than seven decades ago, morphed into a global engineering giant. It wasn’t just solar installations but power-transmission lines and water-desalinization plants.

The far-flung expansion, from Brazil to India, with each project raising financing as it went along, cloaked how much the entire operation was borrowing: too much, as it turned out. Even with world leaders gathered in Paris promising a climate-change deal likely to bolster solar operators, Abengoa is fighting to stave off what would be Spain’s biggest corporate collapse.

ReutersAnd finishing off, a long interview with one of the strongmen in Rusatom, courtesy of Reembrandt Kopelaar. It sheds some rare light on the vision within this company for the future of Nuclear power. While this energy technology will mostly disappear from Europe in the decades to come, it seems bound to expand elsewhere.

Egypt expects to start power output from 1st nuclear reactor by 2024

28-11-2015

[...] On Nov. 19, Egypt said Russia will extend it a loan to cover the cost of constructing a nuclear power plant in Dabaa that is expected to be complete by 2022. Egypt had been considering a nuclear plant at Dabaa since the 1980s.

"The production capacity for each reactor is 1,200 megawatts... The first unit is due to start service in 2024," Sherif Ismail said in a televised speech.

Energy PostAnd that is it for this time. Thanks to Dave Thomas for the help compiling this review.

Kirill Komarov, First Deputy Chief Rosatom: “The future belongs to fast-neutron reactors with closed fuel-cycle”

Karel Beckman, 24-11-2015

“Globally there are no alternatives that can replace nuclear power”, but with the growth of renewables, “the demand for very large nuclear reactors will drop”. That is the view of Kirill Komarov, First Deputy CEO of the Russian nuclear giant Rosatom. “Fast-neutron reactors with a closed fuel cycle will secure baseload and low and medium capacity reactors will serve balancing needs”, says Rosatom’s “number two” man in an exclusive wide-ranging interview in which he speaks frankly about sensitive issues such as Iran, radioactive waste, the Hinkley Point C project in the UK, “dependence” on Russia and competition from renewables.

[...] “Rosatom reinvests 5% of its revenues in R&D to reinforce our technological leadership. We will probably be the first in the world to commercialize fast-neutron reactors, floating nuclear power plants and low-capacity reactors. The FNR-based closed fuel cycle technology supports the global objective of creating a waste-free nuclear industry. At present, the fast-neutron reactor BN-800 operating at Beloyarskaya in Russia is the only one in the world. Russia is world leader in this area of nuclear power engineering.

In addition, in August the Mining and Chemical Combine, a subsidiary of Rosatom, put into operation a new facility for the production of MOX (mixed oxide) fuel, the first enterprise in the world to implement this at industrial scale. Such technology means transforming uranium-238 into an energy resource will pave the way for the development of waste-free technologies capable of providing energy security for the planet in the long term. Since nuclear generation is not associated with greenhouse gas emissions, one can produce any amount of energy using uranium-238 without any harm to the climate.”

Have a pleasant weekend.

No comments:

Post a Comment