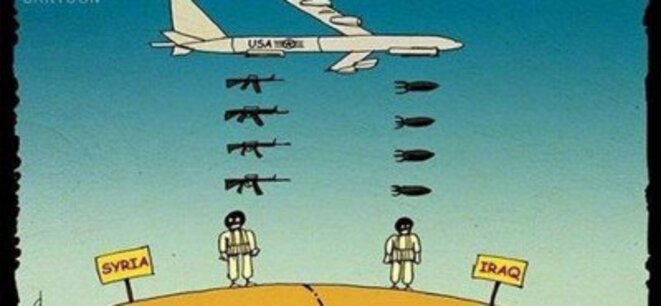

In spite of these data, in my view the Sunni-Shiite war in Iraq and Syria remained the major story of 2015. With dozens of countries involved in one way or another, this war is building into a focus of tension unprecedented since the Iranian revolution. The past few years I have tried in this reviewed to answer a simple question: is Europe on the right side in this war? But is it even clear on which side are we? The article that opens this last review of 2015 dives deep into this war, showing that things are not at all straightforward and that perhaps Europe is really wrong footed, embroiled into a trap of its own making.

An hiatus to the press review is likely to follow; details are at the end of this note.

This is highly recommended reading. Use an automatic translator if you are not at ease with French.

MediapartAs Dominique Aras brilliantly explains, Europe hits back with economic sanctions at those countries fighting Daesh while it finances countries like Turkey that openly support the Islamic State. Turkey continues to deepen its military involvement in this war, this time attacking the Curds - another of Deash's enemies.

Guerre en Syrie : L’enjeu

Dominique Arias, 10-12-2015

[...] Ce qui manque à la télé, c’est un rétroviseur. À ne regarder que vers l’avant, on voit à peu près ce qui vient d’en face mais on ne comprend rien à ce qui vient de notre côté. Ça apparaît d’un coup, comme ça tomberait du ciel ; une espèce de fatalité : « Ah, la guerre, gross malheur, Ja ! »

Regarder en arrière permet souvent de recadrer une vision d’ensemble et de mieux comprendre ce qui arrive (d’en face !).

[...] C’est quand même un comble, en hommage aux victimes des attentats, on nous demande d’accrocher à nos fenêtres les couleurs nationales de l’un des pays les plus directement impliqués dans la création et l’expansion de Daesh, et qui, même si réellement il ne contribue pas (ou plus) directement au soutien militaire, logistique et diplomatique qui permet à cette organisation terroriste internationale de tenir et de s’imposer en Syrie depuis trois ans, contribue le plus ouvertement du monde à affaiblir ses principaux adversaires sur le terrain par un embargo injustifiable et des sanctions internationales de la première gravité. [...]

The TelegraphShowing the delirious bellicose drive of Turkish leaders are the increasingly worrying figures of the country's gas consumption. In the past month Turkey waged war against its largest gas suppliers: Iran and Russia, at a time when it would actually need to contracted lager volumes to meet increasing consumption. Gas shortages seem a price Turkey is willing to pay to keep supporting Daesh.

The return of war? Turkey's south-east region plunged into 'worst violence in years'

Raziye Akkoc, 20-12-2015

Turkey's troubled south-eastern region has been plunged into some of its worst violence in years as an unprecedented military operation against Kurdish rebels shatters hopes for recent peace talks.

Tanks and armoured personnel carriers have been used in the latest operation, which began on Wednesday and which Turkish authorities claim has already seen 110 Kurdish rebels killed. At least five civilians and two Turkish soldiers have also died, according to an official speaking to AFP.

[...] In the largest operation of its kind since the collapse of the two-year ceasefire between the state and Kurdistan Workers’ Party (PKK) members, around 10,000 police and troops entered cities such as Cizre and Silopi in Sirnak province, south-eastern Turkey, as well as a neighbourhood in Kurdish-majority Diyarbakir.

[...] Air strikes were also launched against alleged PKK hideouts and weapons site in northern Iraq on Friday, the Turkish military said.

PlattsIn their turn, Russia and Iran strengthen their economic ties. What has to Europe to gain from this? Why are our companies not competing for this sort of contracts?

Turkey balances on brink of gas supply crisis

21-12-2015

All eyes in the Turkish gas market have been focused on the possibility of a cut in supplies from Russia in the wake of the November downing of a Russian fighter jet.

But even if all Turkey's gas suppliers fulfil their contracts, the country still faces serious problems.

Turkey's gas consumption last year reached 48.72 Bcm, 7.74% up on the 45.2 Bcm reported in 2013.

This year it was expected to exceed 50 Bcm, perilously close to Turkey's total import portfolio of 52.05 Bcm/year.

UPIAh yes, Peak Oil. Far too soon for a definitive call, but I acknowledge there are good reasons to expect extraction to decline visibly for a while.

Russia starting construction on two nuclear power plants in Iran

Andrew V. Pestano, 22-12-2015

Russia will begin building two nuclear power plants in Iran next week, in the city of Bushehr, where Russian specialists helped build Iran's first nuclear power plant.

Negotiations are ongoing, Behrouz Kamalvandi, deputy head of the Atomic Energy Organization of Iran, told Iran's Mehr news agency.

"Certain steps were taken which have brought about good conditions with regard to decreasing the number of centrifuges," Kamalvandi said, adding that details about the nuclear power plants will be revealed in the coming days.

Kamalvandi said Iran's nuclear industry has grown with foreign collaboration. Russian Industry and Trade Minister Denis Manturov said Moscow is considering lending Iran $5 billion in 2016, possibly as part of a larger free-trade deal between the two countries.

Peak Oil BarrelThis following piece provides a simple explanation to why prices had to dip under 50 $/b for extraction to start declining. This artificial delay will also mean a protracted recovery when the over capacity eventually dries up.

All Roads Lead To Peak Oil

Ron Patterson, 21-12-2015

I follow the JODI World Oil Database primarily because it is now four months ahead of the EIA international data base. I make some adjustments however. I use the OPEC MOMR “secondary sources” for all OPEC data where JODI also uses the MOMR but uses their “direct communication” data instead. The OPEC portion of the JODI data is “crude only” and will therefore be somewhat less than the EIA reports.

I use the Canadian National Energy Base data for Canada instead of the strange numbers JODI has for Canada. And I use the EIA data for the few small producers that JODI does not report.

With these Changes I think I have composed an excellent World Oil Database from this composite data. And with the October data just released I have composed the below charts. The data is through October and is in thousand barrels per day.

Financial TimesOne of the requirements for a recovery in petroleum prices is a recycling of all the companies presently operating at a loss, which at the US right now means almost all of them. The number of bankruptcies is finally fattening up, but this is still far from the required overhaul the industry requires.

Financialisation compounds commodity rout

Satyajit Das,

[...] The downturn is exacerbated by increased financialisation, which converted commodities into tradeable equivalents. Cash flows from future sales were monetised to raise large amounts of debt to finance expansion. The collateral value of commodities secured expansion in borrowing and trading. Derivatives allowed new participants, other than consumers and producers, to invest in and trade commodity price expectations.

Global lending to the energy sector alone totals around US$2.5tn. Between 2004 and 2014, emerging market corporate debt increased from US$4tn to US$18tn, much of the increase taking place since 2008.

A significant portion of this debt — especially in China, Russia, Brazil, Mexico and Chile — is related to commodities. Resource companies now face a testing combination of lower revenues, a shortage of US dollar income to meet debt payments and currency losses on dollar borrowings.

The need to maintain cash flow to service debt requires production levels to be maintained, even if it is below cost. This delays the withdrawal of supply and correction of prices. It also destroys the value of equity, making it difficult for firms to raise new capital to reduce debt.

BloombergBy and large, banks keep supporting this money haemorrhage, but bankruptcies and revisions to speculative reserves are starting to bite. Regulators are showing signs of worry; can they do anything relevant this late in the game?

Oil Bankruptcies Reach Highest Quarterly Level Since Recession

David Wethe, 24-12-2015

Bankruptcies among oil and gas companies have reached quarterly levels last seen in the Great Recession, according to the Federal Reserve Bank of Dallas.

At least nine U.S. oil and gas companies that accounted for more than $2 billion in debt have filed for bankruptcy in the fourth quarter, the bank said Wednesday in its energy economic update for the final three months of the year.

"Lower oil prices have taken a significant financial toll on U.S. oil and gas producers, in part because many face higher costs of production than their international counterparts do," according to the note written by Navi Dhaliwal, a research assistant, and Martin Stuermer, a research economist. "If bankruptcies continue at this rate, more may follow in 2016."

Financial TimesIn parallel, the US gas market is getting hardly hit too. There is no way to see an happy ending to this story.

US banks hit by cheap oil as Opec warns of long-term low

Laura Noonan and Ben McLannahan, 23-12-2015

US banks face the prospect of tougher stress tests next year because of their exposure to oil in a sign of how the falling price of crude is transforming the outlook not just for energy companies but the financial sector.

[...] Today’s oil prices are about 55 per cent below their level when the Fed set last year’s stress test scenarios in October 2014. That test included looking at how banks’ trading books would fare if there was a one-off 68 per cent fall in oil prices sometime before the end of 2017. Banks’ loan books were not tested against falls in oil prices.

Banks including Wells Fargo have recently spoken about the dangers of low oil prices that could make exploration companies and oil producers unable to pay their loans. There are now five times as many oil and gas loans in danger of default to the oil and gas sector as there were a year ago, a trio of US regulators warned in November.

WolfStreetWhile I remain cautious on petroleum peaking, things look somewhat more crystalline with coal. No one could imagine coal would peak before petroleum, but so it seems.

Carnage in US Natural Gas as Price Falls off the Chart

Wolf Richter, 18-12-2015

The price of natural gas in the US has gotten completely destroyed. The process started in July 2008, at over $13 per million Btu and continues through today, at $1.77 per million Btu.

In between, natural gas traded at prices that, for much of the time, didn’t allow drillers to recoup their investments, leading to permanently cash-flow negative operations, and now huge write-offs and losses, defaults, restructurings, and bankruptcies.

You’d think that this sort of financial misery would have caused investors to turn off the spigot, and for production to fall because drillers ran out of money before it got that far.

The TelegraphThe coal market seems considerably more severe at the moment. The industry is somewhat different, with fewer companies of larger size. Peak Coal might not have the same financial implications as the decline of source rock exploration in North America, but the economic pain to exporting countries is unavoidable.

International Energy Agency sees 'peak coal' as demand for fossil fuel crumbles in China

Ambrose Evans-Pritchard, 19-12-2015

China’s coal consumption has been falling for two years and may never recover as the moment of "peak coal" draws closer, the International Energy Agency (IEA) has said.

The energy watchdog has slashed its 2020 forecast for global coal demand by 500m tonnes, warning that the industry risks unstoppable decline as renewable technologies and tougher climate laws shatter previous assumptions.

[...] Mines around the world are at increasing risk as prices slump to 12-year lows of $38 a tonne, and the super-cycle gives way to a pervasive glut. The IEA said the $40bn Galilee Basin project in Australia may never become operational. There is simply not enough demand, even for cheap, open-cast coal.

The Sydney Morning HeraldApart from secular environmental constraints to coal extraction in China, the present coal market is also marked by a decline of steel consumption in that country. The Empire of the Middle is now flooding the internal market with steel it no longer needs. Note here the adherence of Bloomberg to the "peak demand" deceiving discourse.

Two thirds of world's coal output is loss-making, Wood Mackenzie estimates

Peter Ker, 09-12-2015

More than 65 per cent of the world's coal production is estimated to be unprofitable as prices for both thermal and coking coal head for their fifth consecutive year of declines.

The estimate, which was provided by commercial intelligence company Wood Mackenzie, applies to both types of coal. It would be even higher if sustaining capital spent by miners on things like engine maintenance was taken into account.

The extraordinary estimate illustrates the parlous state of the coal industry, which has been battling slowing demand in Asia and structural challenges surrounding coal's place in an increasingly carbon-conscious world.

[...] Wood Mackenzie said about 33 per cent of Australian coal production would be cash-flow negative at current prices, which have thermal coal exported from Newcastle fetching about $US52.50 per tonne and Queensland coking coal fetching about $US74.45 per tonne.

BloombergThe closing story on renewable energy this time looks into South America, more precisely on the Atacama desert. It shows how financing errors can put at cause projects that are otherwise viable. At the moment the Spanish press is reporting fresh loans from private investors to Abengoa, that should keep the renewable energy giant going, and guarantee projects such as Atacama 1 to be successfully concluded.

Get Used to China Steel as Macquarie Sees It Getting Cheaper

22-12-2015

The world needs to get used to cheap Chinese steel, with export prices poised to fall again next year as the world’s biggest producer adjusts to demand that’s dropping for the first time in a generation.

The price of hot-rolled coil, used in everything from fridges to freight containers, may decline about 13 percent next year, Colin Hamilton, Macquarie Group Ltd.’s head of commodities research, said by phone from London. The nation’s steel exports, which have ballooned to more than 100 million metric tons this year, may stay at those levels for the rest of the decade as infrastructure and construction demand continues to falter.

While falling steel prices are partly driven by the collapse in raw materials and lower output costs, “it’s just more to do with the fact the industry was built for demand growth that hasn’t come through,” Hamilton said last week. “We’re past peak steel demand. I think provided there is overcapacity in the Chinese system and given where demand is, it’s going to be like this for some time.”

The GuardianThat is it for this week and this year. One week from now I will be living in another city - Zürich - where I will restart my research career. With the move to take care in the meantime, and uncertainty regarding internet connectivity, an hiatus to this press review is likely to follow. I will return as soon as possible.

Desert tower raises Chile's solar power ambition to new heights

Jonathan Watts, 22-12-2015

Rising more than 200 metres above the vast, deserted plains of the Atacama desert, the second tallest building in Chile sits in such a remote location that it looks, from a distance, like the sanctuary of a reclusive prophet, a temple to ancient gods or the giant folly of a wealthy eccentric.

Instead, this extraordinary structure is a solar power tower that is being built to harvest the energy of the sun via a growing field of giant mirrors that radiate out for more than a kilometre across the ground below with a geometric precision that is reminiscent of contemporary art or the stone circles of the druids.

[...] The main structure - which is already taller than London’s Gherkin or New York’s Trump Tower - is almost finished. The next big challenge will be to lift one of the heaviest slabs of steel ever made - the 2,000-tonne solar receiver - to the top with hydraulic jacks. This will be used to heat a pool of 50,000 tonnes of molten salt up to temperatures of 565C during the day so it can continue to drive turbines through the night. All that is needed after that is to polish the 10,600 heliostatic mirrors so that they can reflect sunlight up to the tower. The end result will be the dream of sustainable energy supporters - a solar facility that can provide baseload power generation of 110 megawatts (MW) for 24 hours a day.

Best wishes for 2016.

No comments:

Post a Comment