Titling the last press review of 2015 I asked if that had been the year petroleum peaked. The question mark was not just a precaution, the uncertainty was really there. Five months later the reported world petroleum extraction rate is pretty much still were it was then. This is not a surprise, but the impact of two years of depressed prices is over due.

Titling the last press review of 2015 I asked if that had been the year petroleum peaked. The question mark was not just a precaution, the uncertainty was really there. Five months later the reported world petroleum extraction rate is pretty much still were it was then. This is not a surprise, but the impact of two years of depressed prices is over due.

Nevertheless, during these five months of lethargy the information I gathered brings me considerably closer to remove the question mark from the sentence and acknowledge that a long term decline is settling in. Understanding the present petroleum market as a feature of the supply destruction - demand destruction cycle makes this case clear.

Looking Backwards

Worldwide petroleum extraction hit some sort of ceiling back in 2004, once it crossed above 70 Mb/d. The volume coming to the market kept increasing, but at a shy pace. From 2004 to 2012 the extraction rate grew only 3%, from 72 Md/b to 74 Mb/d.

At the same time, the Brent index endured a remarkable rise from 2004 to 2008. Some called this the "end of cheap oil", alluding to the increasing need for lower return-on-investment resources: ultra-deep water, heavy petroleums, Arctic, etc. Nevertheless, the price collapsed to a third from 2008 to 2009. Back then I explained how the concept of an ever rising petroleum price was at odds with "peak oil". For the world extraction to enter a declining trend, periods of supply destruction must take place to keep those higher entropy resources at bay.

Today the market lives the second supply destruction cycle since the 2004 shift. In reality these cycles are revealing far longer than I anticipated, showing a considerable time lag in the adjustment of the supply curve. There is however something especial to this supply destruction cycle, that could possibly be sealing the end of growth to what petroleum is concerned.

The Miracle

Some days ago I had the opportunity to watch a picture titled "The Big Short", an opus on the 2008 financial crisis. It portraits remarkably well how the marriage of ignorance with the lack of scruples can concoct the most toxic of outcomes. The so called "shale oil boom" is not much of a different story, only perhaps at a different scale.

From 2011 to 2013 the extraction of petroleum from source rocks and other low permeability reservoirs in the US grew almost 2 Mb/d. These were remarkable days for the industry, with plenty of jobs created and a major revival to the American hands-on approach to business. However, such a rapid growth on a relatively small resource left many wondering if something else was at play.

By the beginning of 2014 it was becoming evident that the "shale oil boom" had been largely fuelled by the finance industry, that was feeding relentless amounts of what is sometimes called "dumb money" to be burned on America's source rocks. The scheme was simple: petroleum companies inflated their reserve assessments 10 times or more and imprudent investors kept buying bonds irrespective of losses. They thought they were investing on conventional 30 years petroleum bearing wells, when in fact were getting 3 years lifetime wells.

By late 2014 "shale oil" extraction in the US had increased 3.5 Mb/d since 2011, but at that point the price of petroleum in international markets was already coming off a cliff. 200 G$ rested on the American junk bond market, left to be trounced by a deep supply destruction cycle.

A bond default and bankruptcy wave formed throughout 2015, and is still surging today. One third of the companies involved in the "shale boom" should go belly up this year alone. However, these financial owes have not yet translated into a visible decline in extraction rates. This means that even bankrupt, petroleum companies are still bringing new source rock wells online, only deepening further the present supply destruction cycle.

When the WTI index (the regional equivalent to Brent) sank under 40 $/b late last year, Arthur Berman produced a most elucidating set of maps spatially portraying well profitability. At those prices only a small fraction of the wells extracting petroleum in the Permian formation were profitable.

And this is the remarkable achievement engendered by the marriage of America's petroleum and finance industries. Petroleum extraction became effectively insulated from prices; bankrupt or not, the wells on the Permian, Bakken and Eagle Ford formations will keep pumping - because the dumb money keeps burning. For the rest of the world, this is like inserting a sliver of 4 Mb/d at 0 $ at the far left of the supply curve, pushing all other resources rightwards. For an international industry already in contraction, this is like adding gasoline to the fire.

Supply Destruction

The present supply destruction cycle dates back to the beginning of 2014 - it actually unfolded before the price collapse. While prices still held above 100 $/b, international petroleum companies started facing issues regarding shareholder revenues. The supply curve is simply becoming too steep, when resources such as "Arctic oil" or "pre-salt" enter the portfolios of petroleum companies. The scale down of exploration activities started that year, as so the slashing of staff. In 2014 circa 100 000 jobs were laid off by the industry.

The price rout brought about by the shale miracle only accelerated this contraction. In 2015 the number of jobs laid off is estimated to have hit 250 000. 2016 could end up close to that.

In panic mode, petroleum companies have been postponing or outright cancelling projects. Recent estimates point to a total of 400 G$ in deferred investments. A new wave of mergers in the industry is now expected.

Throughout 2015 only 2.8 Gb were identified in new reserves, the lowest score since the end of the II World War. This figure is less than one tenth of yearly consumption.

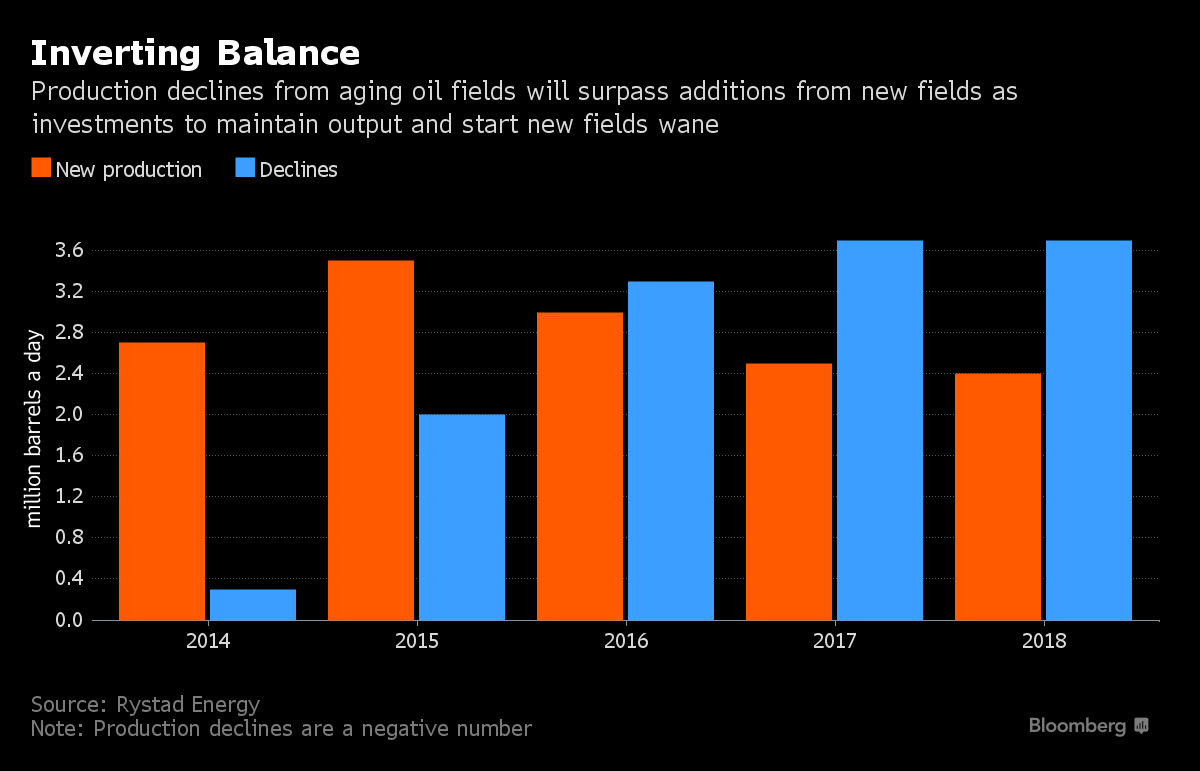

This contraction cycle will resound for years to come. Existing fields decline at a rate somewhere between 4 % to 5 % per year, meaning that the industry needs to bring online additional 3 Mb/d to 4 Mb/d every year just to keep extraction levelled. The investment deferrals under way and the time lag required to bring new fields online guarantee this replacement will be missed several years going forwards.

Rystad Energy, a Norwegian petroleum and gas business intelligence consultancy, projects new extraction projects to miss the yearly decline of existing fields for at least the next five years. This consultancy expects an overall extraction decline of 300 kb/d this year, 1.2 Mb/d in 2017 and 2018 and deeper declines in 2019 and 2020.

Looking Forwards

In a previous post I analysed the gap between petroleum extraction and consumption reported by the IEA. Using data fragments published by the press I then produced an estimate for China's stock flows that greatly explains what have been heretofore unaccounted barrels. In essence, the OECD and China could have amassed together a total of extra 900 Mb in stocks since the beginning of 2014.

Using this estimate for worldwide stocks I was then able to compute world petroleum consumption for the past two years. There are also reasons to believe the IEA is underestimating consumption, but this estimate produces a conservative (nearly best case) scenario: growth of 1.25 %/a.

Matching the outlook produced by Rystad with this consumption trend one can start the always risky exercise of predicting the future. In this case I projected forwards the consumption pattern of 2015 - with a double slump in later Winter and Spring, and the Summer up-tick - increasing at the steady pace identified before. As for extraction, I simple spread Rystad's outlook into a monthly dataset. The end result can be observed in the graph below.

The extraordinary stocks built by the OECD and China since 2014 are projected to hit 1 Gb right about now, but also to soon stop growing. None of this counts with the fires in Alberta, or the social-economic owes endured presently by Nigeria or Venezuela. Still, in this conservative scenario consumption is just about to exceed extraction.

In the scenario above I also made the exercise of estimating how long can these extraordinary stocks last if they are immediately released on the market to stave off an immediate price reaction. That being the case, the extra stocks built by the OECD can alone keep consumers happy until the end of 2017; to go beyond that China has to follow the same strategy. However, if the trends identified here prevail, by the beginning of 2018 consumption will be exceeding extraction by almost 3 Mb/d, exhausting the remaining stocks of 0.5 Gb in a matter of months.

How likely is this scenario? Is the OECD willing to bring its stocks promptly on the market to keep prices where they are now? Or will it wait for prices to rise to provide breathing air to the petroleum industry? And for how long can countries like Iraq, Nigeria or Venezuela withstand prices under 100 $/b?

As the events of recent months show, it might be far more likely for some disruptive happening to shake things up, than for these pretty trends to endure. In any case, this supply destruction cycle is coming to an end sooner rather than later. The market will eventually have to fix the widening gap projected in the graph above.

Consequences

These two years of supply destructive prices have pushed various important petroleum nations and regions to the brink. If there is some unexpected event shaking up the petroleum market, it will likely be in one of these places.

Iraq - a country in war and divided in four different zones of military influence. The impact of low petroleum prices on the Bagdad budget is postponing a victory over Daesh and brewing political chaos. The increase in extraction of recent years halted and could reverse if the politico-military situation does not improve. Daesh' burnt land policy is not helping either.

Nigeria - shortages of hard currency have greatly impaired daily economic life and an IMF intervention seems likely. In parallel, rebel groups have entailed a series of sabotage operations on petroleum assets. Petroleum extraction should decline visibly in the next few years and some fields even abandoned if petroleum prices stay below 60 $/b.

Venezuela - overwhelmed by a snowball effect where under-priced petroleum causes such economic disruption that impacts extraction itself. Exporting less petroleum for less money and on the verge of serious social convulsion.

Canada - petroleum regions in depression menace to drag down the whole economy with visible impacts on housing and all industries related to extraction. Number and size of new projects greatly reduced in recent months may augur an almost unthinkable long term extraction decline in the country with the largest claimed petroleum reserves in the world. The long term effect of the wild fires raging presently in Alberta is still unknown. If petroleum facilities are destroyed, it might not be easy to recover with prices under 50 $/b.

Angola - ran out of hard currency reserves to pay foreign contractors, sending the latter on the run. Presently negotiating an aid programme with the IMF. Meanwhile, the ruling regime has imprisoned numbers of opponents. Petroleum extraction bound to decline in the next few years.

Azerbaidjan - for long in "secret" talks with the IMF over an aid programme. Ambitious prospects for export hikes are likely unattainable.

Mexico - lost 1 Mb/d to depletion during the past ten years and is unlikely to hold or halt the decline. Relevant downwards reserve revisions have been conducted in recent times.

Brasil - engulfed in political chaos tied to misuse and mismanagement of its national petroleum company, Petrobras, one of the most indebted companies in the world. The pre-salt resource seems adjourned sine die.

North Sea - extraction is expected to stop in 100 different fields throughout 2016.

Conclusion

Depending on how the OECD (and perhaps China) decide to manage their extra petroleum stocks, the shift to a new demand destruction cycle closing the gap portrayed in the graph above will be complete by early 2018 the latest. If something goes seriously wrong with one of the key petroleum exporting nations, this shift could happen overnight.

What will such new cycle bring? Recent experience provides some clues: it took eight years for world extraction to rise from 72 Mb/d to 74 Mb/d; the so called "shale boom" required four years at prices above 110 $/b. These long time lags mean that Rystad's declining outlook is by this time almost certain.

The coming demand destruction cycle is therefore likely to be a long one too. And at some point it can invert the extraction trend upwards. In such a scenario, can extraction return to the 80 Mb/d rate of 2015? That is the big question, which I will abstain from answering definitively. Looking at it from the other side of the equation, for such a scenario to ever materialise, demand must withstand again a good number of years at high prices without undershooting.

The successive supply destruction - demand destruction cycles are the key dynamics of peak oil at an yearly scale. These cycles push left and transform each curve in succession, eventually producing a stall of traded volumes and finally a decline. The petroleum market has endured a supply destruction cycle for almost two years now, that while clearly closing, is yet far from the 100+ $/b price required to provide a reversing signal to the industry. With various petroleum exporting nations on the brink - in great measure due to the financial machinations concocted in the US - this supply destruction cycle might have been just too long.

The Take Away

- "Shale oil" is effectively insulated from prices by the US finance industry.

- Present supply destruction cycle is coming to an end.

- After two years of low prices, extraction is set for a multi-year decline.

- New demand destruction cycle to start in the next 18 months, depending on how stocks are managed.

- A return to an extraction rate of 80 Mb/d seems unlikely for the foreseeable future.

- Can it ever return?

No comments:

Post a Comment