And it is not only corporations, entire countries face the risk of default with present petroleum prices. Nigeria is the first to get financial aid from international institutions, and in all likelihood will not be the last.

Pundits and all sorts of important folk continue to maul the mantra that petroleum will be cheap forever or even become free. In the mid term, the volume of petroleum that can be economically brought on the market at 30 $/b is less that 40 Mb/d (and possibly closer to 30 Mb/d). There is only one way for this situation to last: a collapse of consumption.

Financial TimesMoves to support ailing national petroleum companies likely point to the next countries in need of foreign aid. As reported in previous reviews, Petrobras alone seems too big to fail at a planetary scale.

Nigeria asks for $3.5bn in global emergency loans

Shawn Donnan and Maggie Fick, 31-01-2016

Nigeria has asked the World Bank and African Development Bank for $3.5 billion in emergency loans to fill a growing gap in its budget in the latest sign of the economic damage being wrought on oil-rich nations by tumbling crude prices.

The request from the eight-month-old government of President Muhammadu Buhari is intended to help fund a $15 billion deficit in a budget heavy on public spending as the west African country attempts to stimulate a slowing economy and offset the impact of slumping oil revenues.

It comes as concerns grow over the impact of low oil prices on petroleum exporting economies in the developing world. Azerbaijan, which last month imposed capital controls to try and halt a slide in its currency, is in discussions with the World Bank and the International Monetary Fund about emergency assistance.

Wolf StreetWhile countries and big corporations might have official ways to muddle through this market, the does not apply to the small companies operating in the so called "shale" resource of the US.

The Big-Oil Bailouts Begin

Don Quijones, 30-01-2016

[...] In Latin America’s largest economy, Brazil, the government has refused to rule out bailing out Petrobras, once the jewel of the nation’s crown but now a scandal-mired shadow of its former self, weighed down by $127 billion in debt, most of it denominated in dollars and euros.

If it is unable to sell the $15 billion in assets it has targeted by the end of this year – a big IF given how the prices of oil and gas assets have deteriorated – Petrobras might need some serious help from Brazil’s Treasury. According to Citi, that help could reach $21 billion – just enough to plug the company’s cash hole and fix the capital structure on a sustainable basis. That’s a big payment for a government that has on its hands a widening budget gap, a 4% economic contraction, and double-digit inflation.

Brazil is not the only Latin American economy entertaining a bailout of its national oil company. The government of Mexico just announced that it quietly injected 50 billion pesos ($2.7 billion) of public funds into the coffers of state-owned oil company Pemex.

CNBCRight and left there are news of cancelled projects and ensuing declines in extraction. This will become visible in the monthly data very soon.

These energy companies are running low on cash

Mark Fahey, 30-01-2016

One in 5 energy companies could be out of cash in less than six months, while 1 in 3 will hit that threshold in less than a year, according to a Big Crunch analysis.

Publicly traded energy companies as a whole may have $284 billion in cash and short-term assets on their books, but more than 80 percent of that money belongs to the 25 largest companies. Those entities also tend to still have positive cash flows — even the few that are negative have enough cash to last at least two years, according to Big Crunch calculations.

Yet the smallest energy companies — the ones whose names are not as well-known as ExxonMobil, BP or Chevron — are not as lucky. Dozens of small energy companies had already filed for bankruptcy by December, owing a collective $13 billion, according to law firm Haynes and Boone. Many more could join them in the next year, and some may be scooped up by opportunistic buyers. Expects say that as many as a third of American oil and gas companies and half of U.S. shale drillers could disappear into insolvency before oil prices recover.

Looking at the smaller half of companies traded on the NYSE and Nasdaq, more than half of those companies are burning cash fast enough to be out within six months (based on their cash flow in the last two reported quarters).

Environment 360The North Sea is not exactly the most expensive petroleum and gas region in the world, therefore one should extrapolate the news of fields in risk of shut in because of the present price. For smaller fields this shut in may actually mean an early end of life.

Once Unstoppable, Tar Sands Now Battered from All Sides

Ed Struzik, 01-02-2016

[...] Many companies have already conceded that they do not have a future in an economic and regulatory regime that rewards lower costs and lower emissions and penalizes big polluters. According to Wood Mackenzie, an energy consulting company, 800,000 barrels a day of oil sands projects have been delayed or canceled over the past 18 months. That amounts to 16 new projects that have been put on hold or canceled. CNOOC, which recently suspended production at its Long Lake tar sands facility, is reportedly one of a number of other companies looking for ways of bailing out of the tar sands.

Even the Canadian Association of Petroleum Producers has backed away from its once-rosy forecasts for tar sands expansion. In 2013, it predicted that tar sands production would increase from approximately 2 million barrels per day to 5.2 million barrels per day by 2030. In 2015, CAPP reduced estimated 2030 tar sands production to 4 million barrels a day. Tar sands output could fall even lower, analysts say.

Financial TimesIraq was one of the rising stars the past few years, in spite of the Sunni-Shiite war and the rebelling Kurds. The country indeed brought extraction over 4 Mb/d, but the years of war have left many regions in shambles.

Collapse in crude brings North Sea fields near end of production

Christopher Adams, Kiran Stacey and Chris Tighe, 02-02-2016

As many as 50 North Sea oil and gasfields could cease production this year after a collapse in crude prices to 12-year lows, industry experts have warned.

This would accelerate the North Sea’s decline, potentially bringing forward billions of pounds in spending on decommissioning.

Dozens of smaller fields with high production costs that are approaching the end of their lives have been identified by energy consultants Wood Mackenzie as prime candidates to be shut. Halting output is the first step towards abandonment.

This, in turn, could speed up decommissioning — when operators abandon fields and dismantle decades-old infrastructure, including platforms and pipelines.

ReutersIn parallel to petroleum, gas extraction in the US is also entering a decline. It is far too early to call this a permanent peak; my feeling is that it is not - the resource is far vaster than petroleum. However, it is important to note this trend is settling in while the country is still a net gas importer.

Iraqis running out of food and medicine in besieged Falluja

Stephen Kalin, 02-02-2016

Tens of thousands of trapped Iraqi civilians are running out of food and medicine in the western city of Falluja, an Islamic State stronghold under siege by security forces, according to local officials and residents.

The Iraqi army, police and Iranian-backed Shi'ite militias - backed by air strikes from a U.S.-led coalition - imposed a near total siege late last year on Falluja, located 50 km (30 miles) west of Baghdad in the Euphrates river valley.

The city's population is suffering from a shortage of food, medicine and fuel, residents and officials told Reuters by phone, and media reports said several people had died due to starvation and poor medical care. Insecurity and poor communications inside the city make those reports difficult to verify.

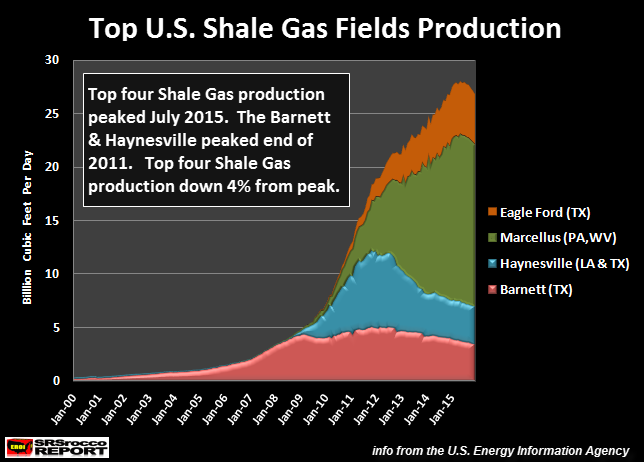

SRSRocco ReportThere are no doubts left on what caused the surge of earthquakes in the US state of Oklahoma. In 2015 there were more than 900 events of magnitude 3 or higher - a stress frequency that most buildings were not designed to withstand. However, local authorities seem powerless to stop the disposal of drilling waste liquids.

ANOTHER NAIL IN THE U.S. EMPIRE COFFIN: Collapse Of Shale Gas Production Has Begun

SRSrocco, 28-01-2016

The U.S. Empire is in serious trouble as the collapse of its domestic shale gas production has begun. This is just another nail in a series of nails that have been driven into the U.S. Empire coffin.

Unfortunately, most investors don’t pay attention to what is taking place in the U.S. Energy Industry. Without energy, the U.S. economy would grind to a halt. All the trillions of Dollars in financial assets mean nothing without oil, natural gas or coal. Energy drives the economy and finance steers it. As I stated several times before, the financial industry is driving us over the cliff.

Very few Americans noticed that the top four shale gas fields combined production peaked back in July 2015. Total shale gas production from the Barnett, Eagle Ford, Haynesville and Marcellus peaked at 27.9 billion cubic feet per day (Bcf/d) in July and fell to 26.7 Bcf/d by December 2015:

DesmogAmong the mainstream stories of the day are the primary elections for candidates to the President of the USA. Ethanol seems to play an important role in this story, that is unlikely to be acknowledged by the mainstream media.

Arkansas Frackquake Victims Commiserate With Oklahomans As Fracking Wastewater Injection Continues, Risking Deadly Earthquakes

Julie Dermansky, 26-01-2016

There is a general consensus in Oklahoma that the record-breaking number of earthquakes occurring in the state are caused by the disposal of fracking wastewater in injection wells. But there’s no agreement on what to do to stop them.

“We are human guinea pigs in a fracking industry experiment,” Angela Spotts, founder of Stop Fracking Payne County and a Stillwater, Oklahoma homeowner, told DeSmog. “Regulators tell us they can get the earthquakes under control as they tinker with the quantity that wastewater wells are allowed to inject into the ground. But despite their efforts, the quakes have continued.”

Spotts’ group has called for a moratorium on injection wells that dispose of fracking wastewater. “Shutting the wells down stopped the earthquakes that hit Arkansas. That is what we need to do here too,” Spotts said.

Matt Skinner, spokesman for the Oklahoma Corporation Commission (OCC), the agency that regulates the state’s oil and gas industry, conceded that, “in a perfect world, shutting down all the wells in ‘the area of concern,’ if done gradually, would be ideal.” But he told DeSmog that is not possible because of “private property rights.”

Eric Peters AutosTo finish off on a more positive note is something that more resembles an anecdote. Once in a while there are news like this, so absurd that can not possibly be made up. And in this case it was the front page at the Financial Times for a few days. There is not even an attempt to quantify the energy or financial return on investment.

Cruzing on Empty

eric, 27-01-2016

[...] Currently, 40 percent of the U.S. corn crop goes to ethanol production – up from just 10 percent as recently as 2005. Most of the unleaded gas available in the United States is actually 10 percent ethanol and 90 percent gasoline. This fuel is labeled “E10″ gas. Which would be ok … if that’s what the market wanted. But it’s actually what the government (and corn lobby) want. And now they want more. Specifically, they want ethanol concentrations upped to 15 or even 25 percent (E15 and E25). And they want whomever is nominated and ultimately elected president to make it so. Big money – and big pressure.

[...] And ethanol in higher concentrations – such as E15 and E25 and E85 (15 percent, 25 percent and 85 percent ethanol, respectively) will cause physical damage to engines and fuel systems not specifically designed and built to handle high-alcohol-concentrations.

Alcohol is by nature corrosive – and it attracts moisture. If you read your vehicle’s owners manual you will find explicit warnings about using any gasoline with more than 10 percent ethanol (E10) unless the engine was designed for it – and an advisory that any damage resulting from its use will not be covered buy the vehicle’s warranty.

Finantial TimesThat is it for this time, have a good week.

Luxembourg launches plan to mine asteroids for minerals

Clive Cookson, 02-02-2016

Mining in space will take a leap from the realms of science fiction towards commercial reality on Wednesday when Luxembourg launches an official initiative to promote the mining of asteroids for minerals.

Luxembourg has a long-standing space industry and played a significant role in the development of satellite communications a generation ago, including setting up SES, one of the world’s largest satellite operators. In collaboration with US and European commercial partners it now aims to help create a space industry to exploit asteroids for metals and other materials that are scarce on Earth but plentiful in “near-Earth objects” (NEOs).

NEOs typically orbit the sun in trajectories tens of millions of miles away — much further than the moon but closer than Mars and within easy reach of unmanned spacecraft.

Jean-Jacques Dordain, director-general of the European Space Agency until last June and an adviser on the Space Resources initiative, told the FT: “I am convinced there is great scientific and economic potential in Luxembourg’s vision.”

No comments:

Post a Comment